New IRS Tax Data Now on PolicyMap

PolicyMap recently updated its Brookings IRS data to include data from returns filed in 2008. This set of indicators provides data on tax return filers in geographies as small as zip codes, with information such as number of returns filed by different income groups and number of specific tax credits claimed. The data has a particular focus on tax returns with an Earned Income Tax Credit (EITC), having extensive data on those filings.

The EITC component makes the Brookings IRS data particularly useful. The EITC is a tax credit for low income filers, typically with children. As such, it is a good way to see statistics on just the working poor on a map. For example, if you were interested in seeing the amount of low-income individuals seeking higher education, a good indicator to look at might be the number of income tax returns that claimed EITC and filed Form 8863, which provides for education credits.

This data is separate from our IRS Statistics of Income (SOI) dataset, which has not yet been updated by the IRS. The Brookings Institution receives its data from the IRS’s Stakeholder Partnerships, Education, and Communication (IRS-SPEC) Return Information Databases, and summarizes it to ZIP codes, cities, counties, metropolitan areas, states, state legislative districts, and congressional districts. It differs from the SOI data in various technical ways, and includes different indicators. The SOI data, for example, contains data on charitable contributions that the IRS-SPEC data does not have.

For the time being, the IRS-SPEC data will be the only 2008 tax data on PolicyMap, as the Statistics of Income Division of the IRS is reviewing its methodology used for its ZIP code data, delaying their data release.

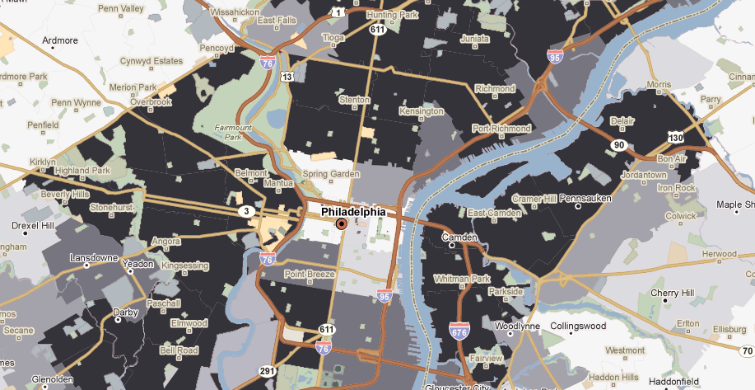

The Brookings IRS data is available in the “Money & Income” tab on the maps page.