BEA Program Distressed Communities Update

In addition to the recent NMTC and CRA eligibility updates, the Bank Enterprise Award (BEA) Distressed Communities data has now been updated on PolicyMap as well! Administered by the Community Development Financial Institution (CDFI) Fund since the program’s inception in 1994, the BEA Program is intended to encourage FDIC-insured financial institutions to finance and support community and economic development activities in distressed areas. The program provides financial incentives to these institutions to expand their financial and technical assistance to CDFIs, thus infusing needed capital to distressed areas.

The CDFI Fund determines Distressed Communities based on geographic and economic criteria. The area must have at least 4,000 people if it is within a Metropolitan Service Area (MSA), at least 1,000 people if it is not in an MSA, or the area must be located within an Indian Reservation. In addition, at least 30% of the area’s population must have incomes less than the national poverty level, and the unemployment rate must be at least 1.5 times the national average.

As part of the CDFI Fund’s efforts to have the eligibility criteria for their programs accurately reflect current economic conditions, the Fund recently released an updated list of Distressed Communities for their BEA Program using eligibility criteria based on the Census’ 2006-2010 American Community Survey (ACS) data. These designations will be applicable for the next five years, and they can be found on PolicyMap under “Federal Incentive Designations” in the Federal Guidelines tab.

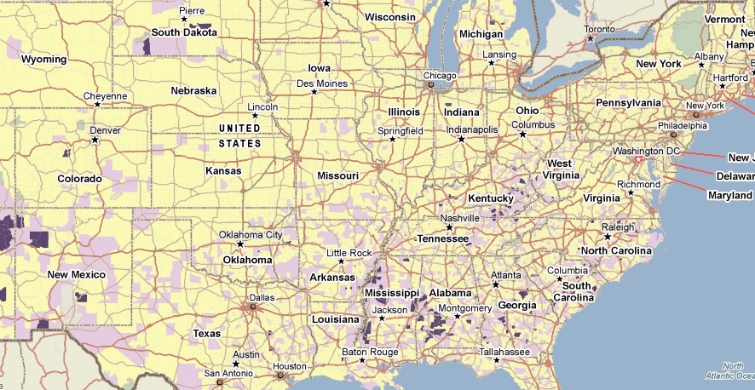

Use the map below to identify census tracts in your target area that fully or partially qualify as BEA Distressed Communities based on the updated eligibility data. And, visit the CDFI Fund’s website for more information on the BEA Program.