Is My Small Business Eligible for SBA Funding?

PolicyMap is making it possible for the US Small Business Administration (SBA) to help small businesses determine if they are eligible for COVID-19 Targeted Economic Injury Disaster Loan (EIDL) Advance funding. If a small business sits in a low-income area, it may be eligible for such a loan.

With almost half of the workforce in the United States employed by a small business, government agencies have prioritized grant and loan programs to help these businesses remain sustainable during the pandemic. The most recent program from the SBA, the COVID-19 Targeted EIDL, went into effect in February of 2021.

The COVID-19 Targeted EIDL Advance is a source of funding specifically for small businesses who have suffered losses due to COVID-19 and are located in low-income communities. The SBA is currently targeting small businesses that had a previous EIDL of less than $10,000 and small businesses who applied for EIDL but did not receive one because funding had been exhausted.

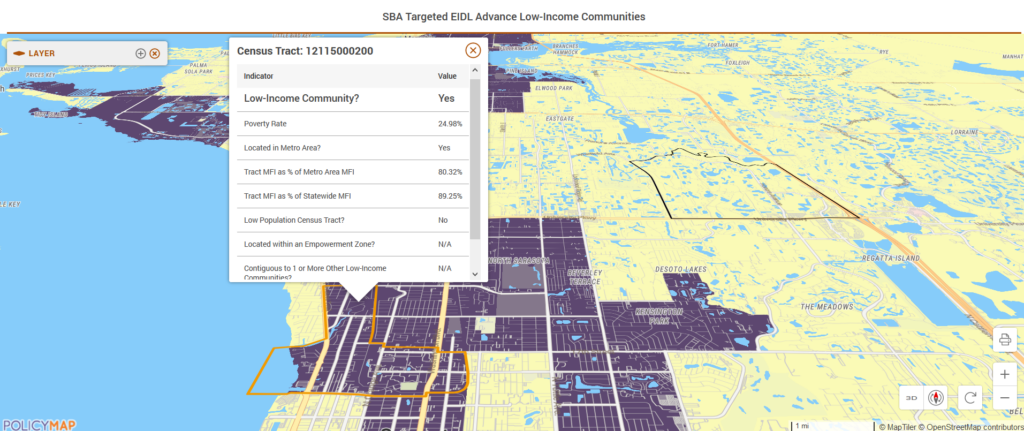

To help small businesses determine if they are located in a low-income community, SBA worked with PolicyMap to identify census tracts across the nation that met all of the conditions of “low-income” as specified by the IRS and to create a mapping tool that would allow small businesses to find out quickly if their business was located in one of these census tracts. The SBA used multiple criteria, including the poverty rate in a census tract and how an area’s median family income compared to the larger metro area. For smaller tracts, SBA wanted to ensure that those sitting in Empowerment Zones or adjacent to low-income tracts were also areas that would qualify for funding.

This yes/no eligibility indicator and the underlying information that was used are available on the PolicyMap tool via the SBA’s website.