Tracking Economic Rebound After COVID-19 with Vacancy Data

Nationwide Pre- and Post-Pandemic Business Vacancy Landscape

While office occupancy hit a post-pandemic high in Q1 2023, bleak reports of empty office buildings and vacant retail space have recently emerged in newsfeeds. So what is an effective way to track economic recovery after COVID-19?

A few months ago, we analyzed Business Vacancies in Philadelphia using the latest data from Vericast’s Valassis Lists. Today, we expand our focus to explore nationwide Business Vacancy trends.

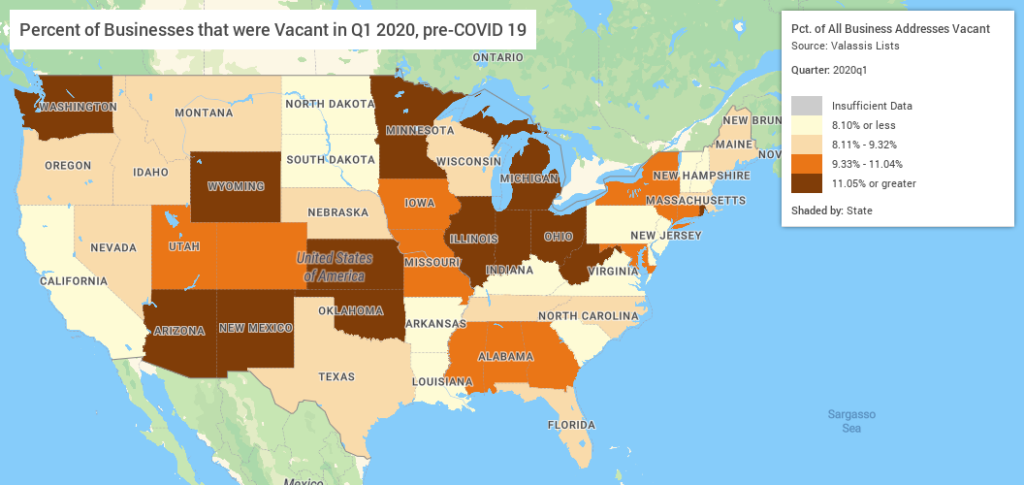

Business Vacancy Rates Before the Pandemic: A Snapshot of Stability (Early 2020)

Before the onset of the pandemic, specifically in the first quarter of 2020, business vacancy rates in nearly all states across the United States hovered comfortably within the range of 8% to 11%. This interval served as the established baseline for business vacancies at that time. While the majority of states adhered closely to this average rate, certain regions like the Rust Belt, Midwest, and Southwest exhibited slightly higher vacancy rates, albeit with some noteworthy outliers. Despite regional variations, the prevalence of the 8% to 11% average vacancy rate underscored its status as a standard metric for gauging business occupancy trends throughout the nation. However, with the advent of the pandemic and its profound impact on the economy, it becomes essential to reevaluate these figures and explore how the business landscape has transformed in subsequent periods.

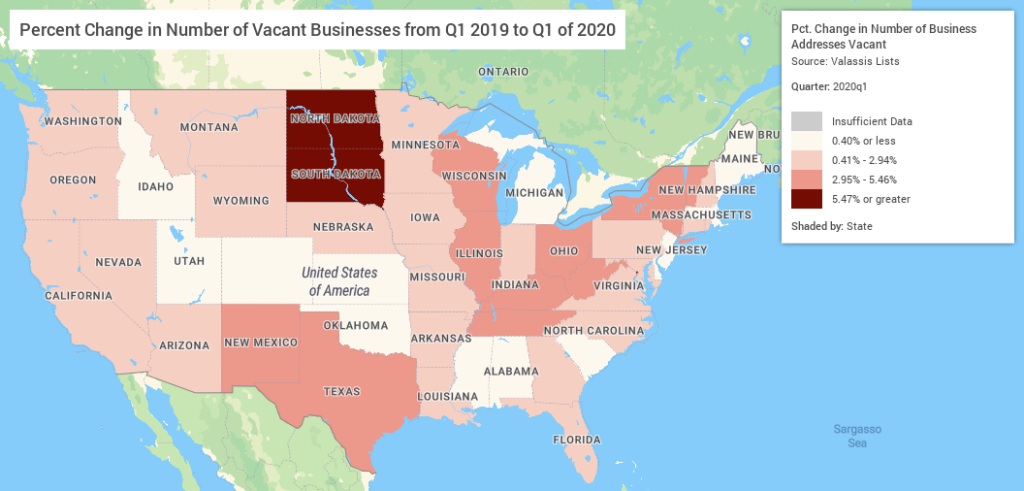

Business Vacancy Rates Before the Pandemic: Establishing a Baseline (2019-2020)

This map provides a visual representation of the year-over-year percent change in vacant business addresses, serving as the key indicator of our analysis. Across the majority of states, we observe minimal increases in business vacancies from Q1 2019 to Q1 2020, a trend that aligns with our expectations. Encouragingly, several regions, including the Midwest, Deep South, and Rocky Mountain states, were experiencing a decline in business closures, signaling positive strides in economic development. Nevertheless, an intriguing outlier emerges in the Dakotas, warranting further investigation. In essence, this data establishes our baseline for monitoring business vacancy fluctuations over time, revealing a general pattern of limited business closures, which, at the time, showed positive implications for economic growth in rural America.

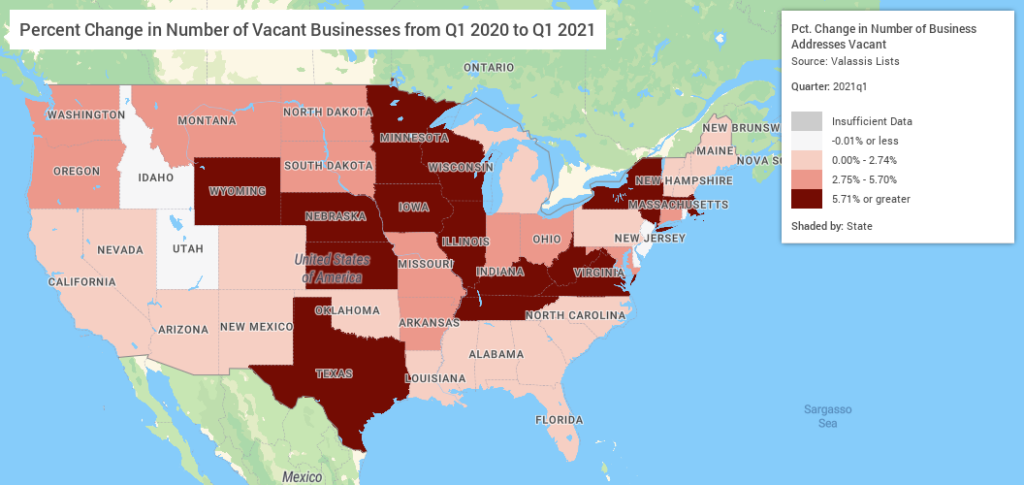

Surge in Business Vacancies: The Impact of the Pandemic (2020-2021)

The advent of COVID-19 unleashed a significant upheaval in the business landscape, particularly evident during the initial year of the pandemic. Across numerous states, there was a notable surge in business vacancies, with the Rust Belt and Midwestern regions bearing the brunt of the impact. Notably affected were the larger population centers of New York and Texas, which also experienced pronounced increases in business closures. On the other hand, the Deep South, West Cost, Southwest, and New England regions demonstrated relatively average rates of business closures, displaying a level of resilience in the face of the pandemic’s challenges. These regional disparities shed light on the varying degrees of economic impact and adaptive responses to the unprecedented circumstances. As we delve deeper into the data, it becomes crucial to understand the underlying factors that contributed to the divergent trends observed in different regions, ultimately informing targeted strategies for economic recovery and revitalization.

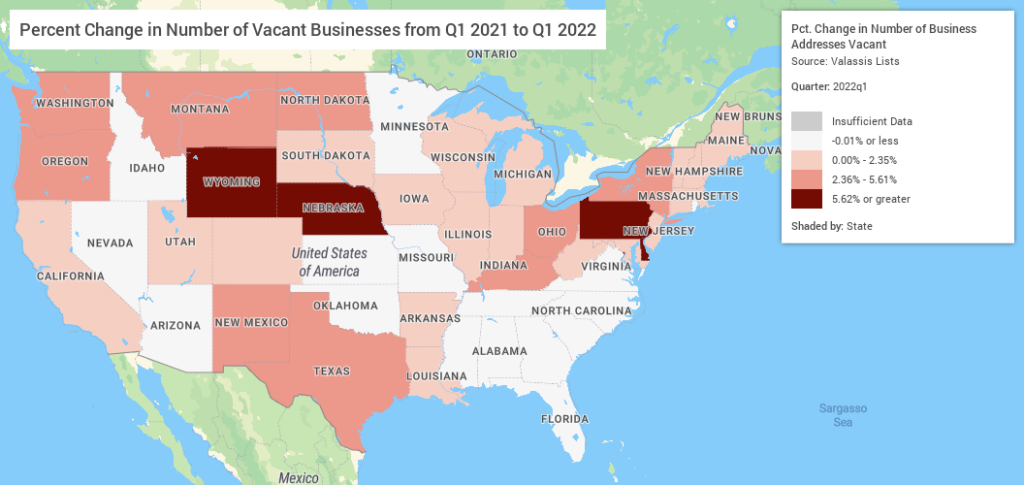

Rebounding from the Pandemic: A Glimpse at COVID Recovery in Business Vacancy Rates (2021-2022)

As we entered the period of 2021 to 2022, the most severe impacts of the economic downturn on business vacancies started to fade away. Across the majority of states, business vacancy rates began to approach the normal levels witnessed before the pandemic struck. Encouragingly, numerous Southern, Central, and Mountain states even experienced a decline in business vacancies, marking a promising sign of economic recovery. Nonetheless, four states, namely Pennsylvania, New Jersey, Wyoming, and Nebraska, continued to grapple with increased business closures, serving as outliers amid the broader national trend. Nevertheless, on the whole, the interval between Q1 2021 and Q1 2022 showcased an encouraging recovery in business vacancy rates, demonstrating the resilience of businesses in the face of unprecedented challenges and paving the way for a more optimistic economic outlook.

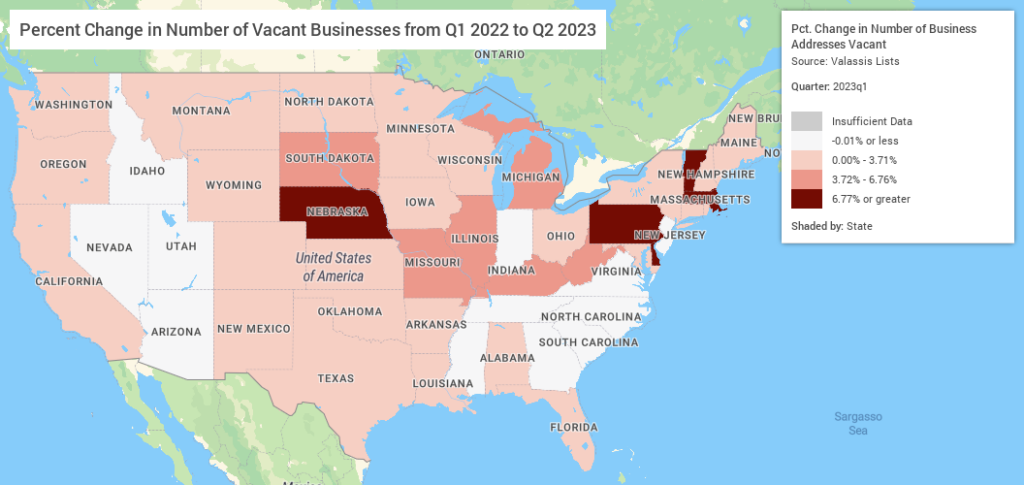

Sustained Economic Recovery: Business Vacancy Trends from (2022-2023)

The positive trajectory of economic recovery persisted from Q1 2022 to the latest data available in Q1 2023. Across the nation, the majority of states witnessed relatively modest increases in business closures, generally staying below the 3% mark, not far off from before the pandemic. Encouragingly, akin to the preceding year, several Southern and Mountain states experienced a decline in business closures, indicating ongoing progress in their recovery efforts. However, a concerning contrast emerged in the Rust Belt, as well as Nebraska, Pennsylvania, Delaware, Vermont, and Massachusetts, where many communities continued to grapple with significant increases in business vacancies, raising cautionary flags for their economic outlook. While overall recovery signals remained encouraging, the divergence in regional performance underscores the need for targeted interventions and support to bolster vulnerable economies and foster a more equitable and robust nationwide recovery.

Request More Information

To learn more about this data and other data on PolicyMap that can shape your research or strategic decision-making, please fill in the form below to contact us.