Where Down Payment Assistance Can Make the Biggest Difference in Tight Housing Markets

It’s hard to consume news about current events these days without running into frequent stories about the nation’s “housing crisis.” There are plenty of fairly disconcerting statistics that illustrate the extent of the issue, particularly for first-time homebuyers. A Pew Research report showed that 18% of adults ages 25 to 34 were still living with their parents in 2023, compared to just 8% of 25- to 34-year-olds in the 1970s. A report from the National Association of Realtors showed that the average age of first-time homebuyers in 2025 reached a record high of 40, and the share of first-time buyers as a percentage of all home purchases had fallen to a record low of 21%. The lack of housing supply affordable to first-time buyers has created a significant barrier to entry into the housing market.

What Local Governments Can Do–and the Role of Down Payment Assistance

There’s no shortage of ways local governments can tackle the housing crunch on the supply side: adjusting zoning to allow for more housing, streamlining zoning to speed up construction, and permitting processes that enable faster building. But more local governments are also turning to another tool to help first-time buyers break into the market, even with today’s limited inventory: Down Payment Assistance (DPA).

DPA programs provide financial assistance to homebuyers in the form of grants or loans to help cover the hefty upfront costs of buying a home, typically the down payment and/or closing costs. While many potential homeowners can manage the month-to-month expenses of ownership, the size of a down payment can be a non-starter, especially for households with limited savings or financial assets. In recent years, more local governments have begun leveraging HUD funding sources, such as Community Development Block Grants (CDBG) and HOME funds, to build more robust DPA programs and unlock homeownership opportunities for a broader swath of low- and middle-income households.

Identifying DPA Priority Areas

When developing a strategy for deploying DPA, local governments may want to identify priority areas within their jurisdictions where DPA funds can stretch the furthest and generate the greatest impact. Below, I walk through a practical use case for identifying DPA priority areas in Buffalo, NY using Multi-Layer Maps in PolicyMap.

In this example, I focus on areas with a supply of homes affordable to moderate-income households, as well as neighborhoods experiencing consistent upward pressure on home prices, signaling a potential threat to affordability in the short- to medium-term. The goal is to prioritize DPA funds in these areas before they become out of reach for low- and moderate-income buyers.

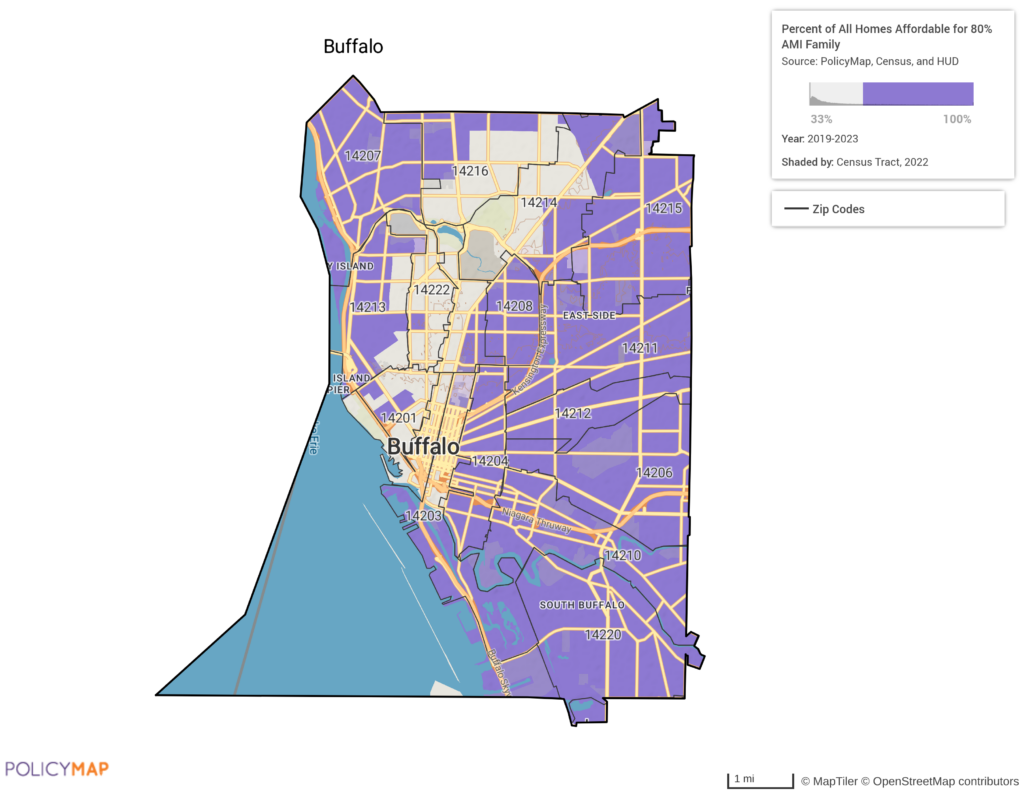

The first map highlights areas in purple where at least one-third of homes are considered affordable for a moderate-income family. These are areas of the city where home values are generally within reach.

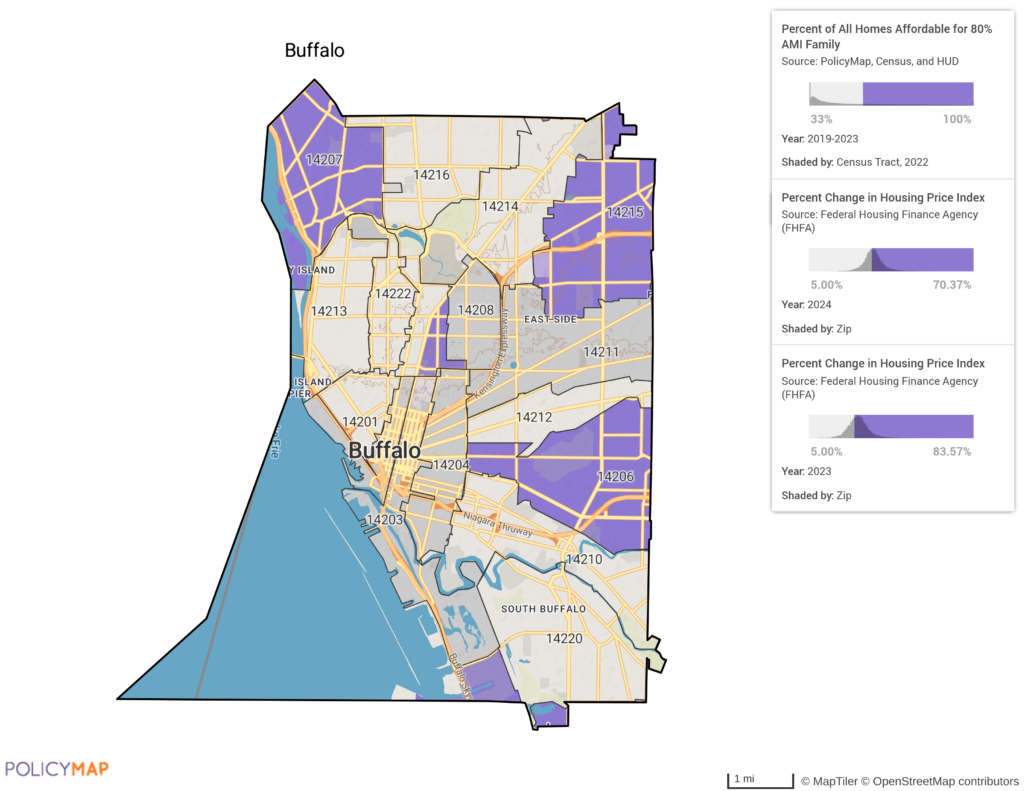

The second map adds two additional layers: changes in the housing price index (HPI) over the past two years for which data is available–2022 to 2023 and 2023 to 2024. For both periods, the map narrows in on ZIP codes where the HPI increased by 5% or more. The resulting purple-shaded areas represent neighborhoods where these factors converge: there’s still a supply of affordable housing, but prices are gaining momentum.

Beyond the visuals, the underlying data can also be downloaded to pinpoint the specific Census tracts that meet these criteria. These tracts are largely concentrated across seven ZIP codes in the city of Buffalo, which can serve as a strong starting point for narrowing the geographic focus of a DPA program.

Explore an interactive version of this map—and zoom in on your own local jurisdiction—using this link (available to subscribers only).

Request More Information

Interested in using this data to guide your housing strategy? To see how PolicyMap can support smarter, more targeted deployment of down payment assistance in your market, fill in the form below. Our sales team touch will be in touch shortly.