The Real Cost of Home Repairs

A PolicyMap and Federal Reserve Bank of Philadelphia joint project.

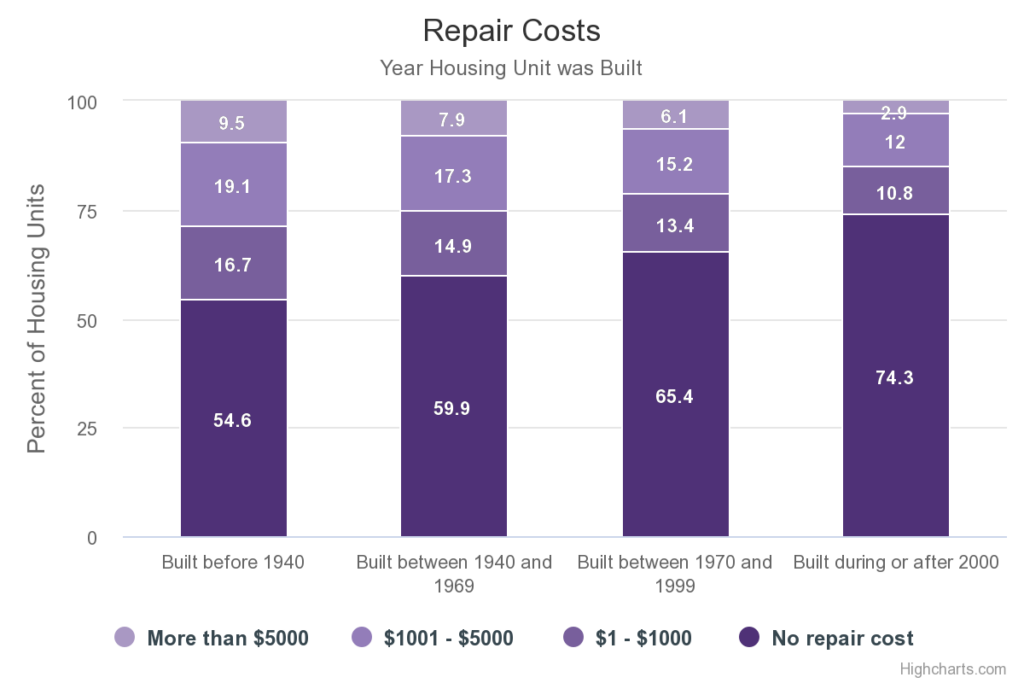

Though the safety and quality of housing has improved in the United States over the last several decades, problems with substandard housing conditions and disrepair persist in many neighborhoods. To discover how severe and costly home repair needs really are, PolicyMap and the Federal Reserve Bank of Philadelphia embarked on a research project to answer the question—how much investment would it take to repair all occupied housing in the United States?

OUR JOINT STUDY SHOWS

$126.9 billion

needed for housing repairs

$2,920 average cost

of repairs for houses in disrepair

More than 1/3

of occupied homes need repair

1 in 20

homes need more than $5,000 in repairs

In order to craft effective policies, housing experts need to know what level of investment, in dollars, is needed to bring homes into good repair. Researchers from PolicyMap and the Federal Reserve Bank of Philadelphia have created a new measure that assigns a repair estimate to every occupied housing unit surveyed in the American Housing Survey. This measure allows us to explore in more detail what kinds of households, in terms of geographic, demographic, and housing unit characteristics, need the most expensive repairs.

The research team is currently developing forthcoming neighborhood-level estimates that will ultimately reveal the extent of local home repair needs, informing the best policy and programmatic ways to address them.

DATA DOWNLOAD

Get Our Repair Cost Estimates

Find out the extent and cost of the housing repair needs in your metro area, and compare it to others across the United States. Under development – census tract and zipcode level estimates.

Explore Repair Costs Across The U.S.

WHITE PAPER

Sharing Insights, Saving Time: New Data Tools for Government

Easily accessible data and mapping tools allow local, state, and federal governments to:

- Improve coordination between departments

- Identify and address threats to public benefits

- Increase transparency

- Respond to new opportunities by finding capacities for growth

- Expedite grant applications

Learn how leading government agencies are using data on maps for better outcomes.

ARTICLE

Read about our study in Cityscape, a publication of the Office of Policy Development and Research at HUD.

Housing quality is inequitably distributed across socioeconomic lines. At the Federal Reserve Bank of Philadelphia and PolicyMap we have quantified repair needs and housing quality to measure the problem.

Advisory Committee

Thanks to the following members of the committee that provided guidance and feedback on this work:

Kermit F. Baker, PhD, Hon. AIA

Senior Research Fellow at Harvard University’s Joint Center for Housing Studies, Project Director of the Remodeling Futures Program; Chief Economist for the American Institute of Architects in Washington, D.C.

George R. Carter

U.S. Department of Housing and Urban Development

Paul Emrath, PhD

Vice President for Survey and Housing Policy Research, National Association of Home Builders (NAHB)

Ira Goldstein, PhD

President, Policy Solutions, Reinvestment Fund

Lauren Lambie-Hanson

Principal Financial Economist, Supervision, Regulation, and Credit, Consumer Finance Institute, Federal Reserve Bank of Philadelphia

Lance Loethen

Vice President of Research, Opportunity Finance Network

Lisa Mensah

President and CEO, Opportunity Finance Network

Jacob Rosch

Senior Policy Analyst, Policy Solutions, Reinvestment Fund

Larry Santucci

Senior Research Fellow, Consumer Finance Institute, Federal Reserve Bank of Philadelphia

Matthew B. Streeter

Social, Economic, and Housing Statistics Division, U.S. Census Bureau

Lance George

Director of Research and Information, Housing Assistance Council

Additional thanks to Joseph Kelble at Gordian and Dave Huber at Kaliber Construction for being generous with their time and expertise.

National Repair Costs By Home

Data Related To Housing Issues

Insights On Current Housing Issues

BLOG POST

A Nationwide Housing Crisis at the Neighborhood Level

Using a report from the Joint Center for Housing Studies of Harvard University, PolicyMap analyzes housing challenges in Austin, Denver, and Dallas.

BLOG POST

Where Neighborhoods Provide Opportunity

In many ways, people’s incomes often depend on where they were raised. Different areas can offer different resources for different life outcomes.

BLOG POST

$126.9 Billion Needed to Repair Nation’s Housing Stock

A report by researchers at PolicyMap and the Federal Reserve looks at investment needed to repair homes, and who is likely to need the costliest repairs.