Tax Returns: A Hidden Gold Mine of Data

I get pretty excited about tax return data. You may recall my really tactful idea earlier this year of asking a blind date for their 1040. It hasn’t really picked up social acceptance yet, but I’m still hopeful, because they can tell you so much about a person. How much do they earn? What kind of home do they own? Do they have children? Are they generous with charitable contributions? It’s enough to fill a Jane Austen novel. (If you’re new to this IRS data, I suggest a read of the earlier blog post.)

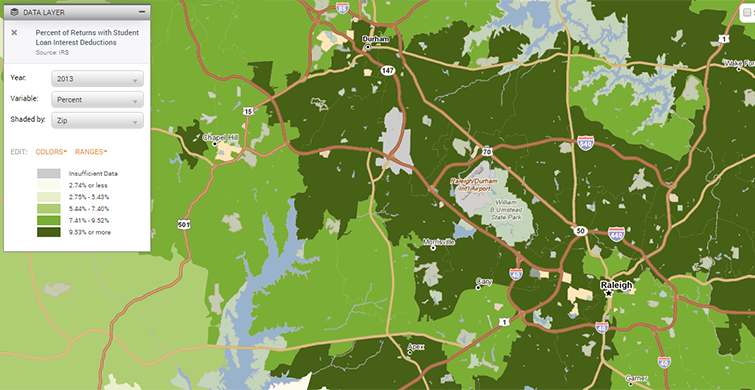

So, naturally, I’m excited that we now have an additional year of tax data from the IRS, for 2013. And even more excited to report some new goodies that will make all the data even more useful.

The first thing we have is 11 new groups of indicators. Each group has data on the number of returns with the credit/deduction/tax/etc., percent of all returns with it, total amount of it in the area (for example, total amount of charitable contributions in a zip code), and average amount of the thing in the area.

Here are the new topics:

- Additional Medicare Tax (part of the Affordable Healthcare Act)

- Net Investments Tax (also part of the ACA)

- Self-employment tax

- Total income

- IRA payments

- Self-employment health insurance deductions

- Student loan interest deductions

- Tuition and fees deductions

- Non-refundable education credits (such as the lifetime learning credit and the American Opportunity Credit)

- Refundable education credits (an additional portion of the American Opportunity Credit)

- Retirement savings contribution credits

There are enough new credits and deductions that we’ve actually split them into two submenus:

The difference between the two sections is deductions (like home mortgage interest) are subtracted from your taxable income, and credits are subtracted from the amount of taxes owed. Most deductions are itemized deductions, which means they’re generally only taken by homeowners with mortgages, and higher income households. Payments are like credits, except you might receive a payment even if you owe no taxes.

There’s another subtle, but very helpful improvement with this update. On any indicator in PolicyMap, you can click on the map header for more information on the indicator.

For this update, we’ve added links to the relevant IRS pages that explain each tax, credit, deduction, and payment. These IRS pages are actually more simple and straightforward than you would expect. Not sure what the Residential Energy Credit is, but intrigued? See what the IRS has to say.

This dataset is very cool, and suffers from having some really boring words attached to it. But go into the Incomes & Spending menu, and look at the Federal Tax Returns section. “Deductions” and “Credits and Payments” are hidden gold mines of data. (Gold mined from your own property is considered natural resource income, and is taxable.)