2015 HMDA Data Shows New Trends in Mortgage Lending

Understanding trends in the mortgage lending market is crucial to evaluating the financial health of many Americans, and PolicyMap has updated the Home Mortgage Disclosure Act data, or HMDA, so that our users can do just that. Mortgage debt comprises the largest share of household debt for Americans, and access to mortgage credit for homeownership represents a crucial component of wealth-building opportunities for many households across the US. Let’s take a look at some of the important trends we’re seeing in the 2015 data.

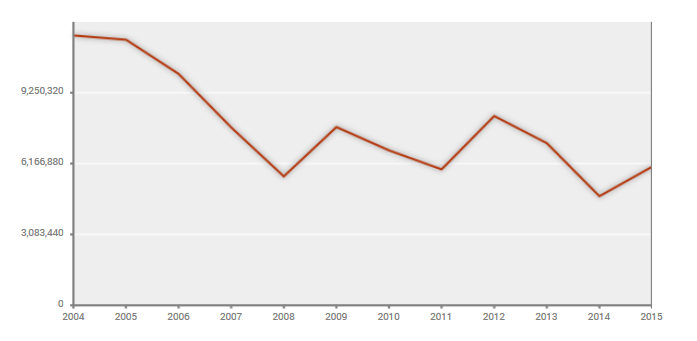

- The number of mortgages of all types (purchase, refinance, etc.) increased in 2015, bringing the national home mortgage lending volume close to 2011-era levels:

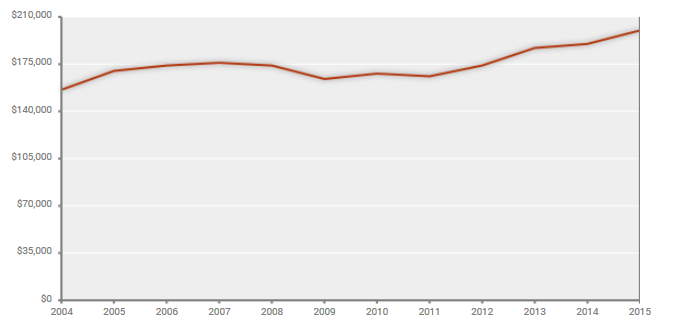

Home Loans 2004-2015 - With the increase in number of all originations also came a steady increase in the amounts of home purchase loans, to a national median of $200,000:

Median Home Purchase Loan Amount 2004-2015 - Government-insured loans, particularly Federal Housing Administration (FHA) loans – that comprised more than 50% of the mortgage market following the mortgage market crisis – now make up around 39% of the market. The share reflects a slight increase from 2014 due to FHA reducing the annual mortgage insurance premium (MIP) it charges. Because loans insured by FHA can require smaller down payments than conventional loans, higher volumes of FHA lending can be an indicator of more concentrated “leveraged” borrowers, borrowers with higher loan amounts relative to their incomes.

According to the Federal Reserve Bulletin, mortgage products have become a bit more accessible for all except those with lower credit scores. Consequently, wealth-building opportunities through homeownership seem to be more accessible in 2015 than in the previous years following the mortgage market crisis. But it continues to remain out of reach to applicants perceived to be higher risk borrowers.