Implications of the One Big Beautiful Bill Act for Housing and Community Development Programs

Ever since the House of Representatives narrowly passed its version of the reconciliation bill, the One Big Beautiful Bill Act (BBB), at the end of May, most of the attention has rightly been focused on its potential impacts on the federal deficit and steep cuts to safety-net programs like Medicaid and SNAP. But for housing and community development stakeholders, there are some silver linings tucked into the BBB. These mostly come in the form of enhancements to certain federal programs that provide tax advantages to qualified housing and community development investments.

The two programs that we’ll focus on in this post are the Low-Income Housing Tax Credit (LIHTC) and Opportunity Zones (OZs). LIHTC is a longstanding program that is the largest federal program for encouraging investment into affordable housing for low and moderate income renters. The OZ program is more recent, first established in 2017 as part of the Tax Cuts and Jobs Act. The impacts of OZs as a community development tool are a bit more mixed, but since inception, the program has generated more than $100 billion in investment into designated zones. These investments typically seem to fund residential real estate projects so OZs have been a significant source of capital for housing development in recent years.

Note: We will be highlighting proposals from the House version of the reconciliation bill because as of the writing of this blog, the Senate version of the bill has not yet been released. Although the Senate Finance Committee has released its portion of the bill, and the proposals within it related to LIHTC, OZs and related programs like the New Markets Tax Credit (NMTC) generally align with the House version. The Senate version actually looks poised to go one step further and make many of these federal community development programs permanent.

Low-Income Housing Tax Credit (LIHTC) Expansion

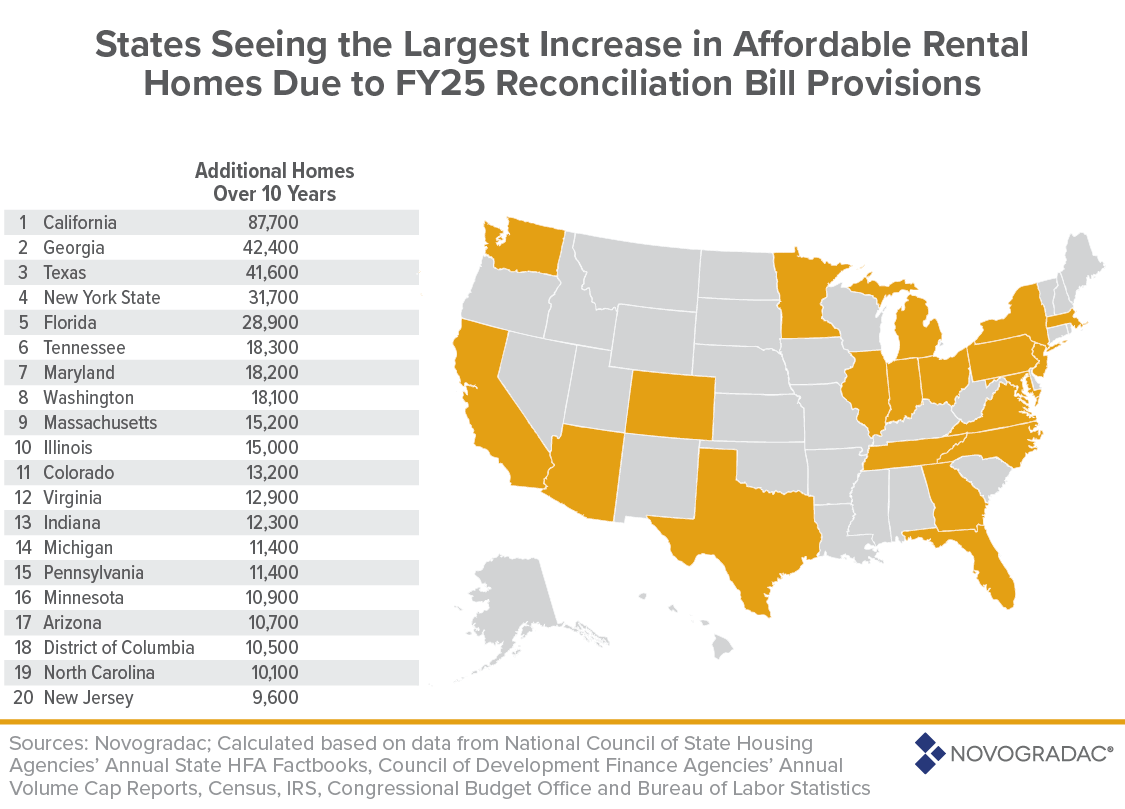

According to an analysis by Novogradac, the changes and additional provisions to LIHTC provided within the BBB could finance an additional 527,000 additional affordable rental homes across the US over the period of 2026 to 2035. This would amount to the largest expansion of the LIHTC in over 25 years.

In their state-level breakdown, Novogradac anticipates that the top 5 states for additional affordable homes over the next 10 years will be California, Georgia, Texas, New York, and Florida.

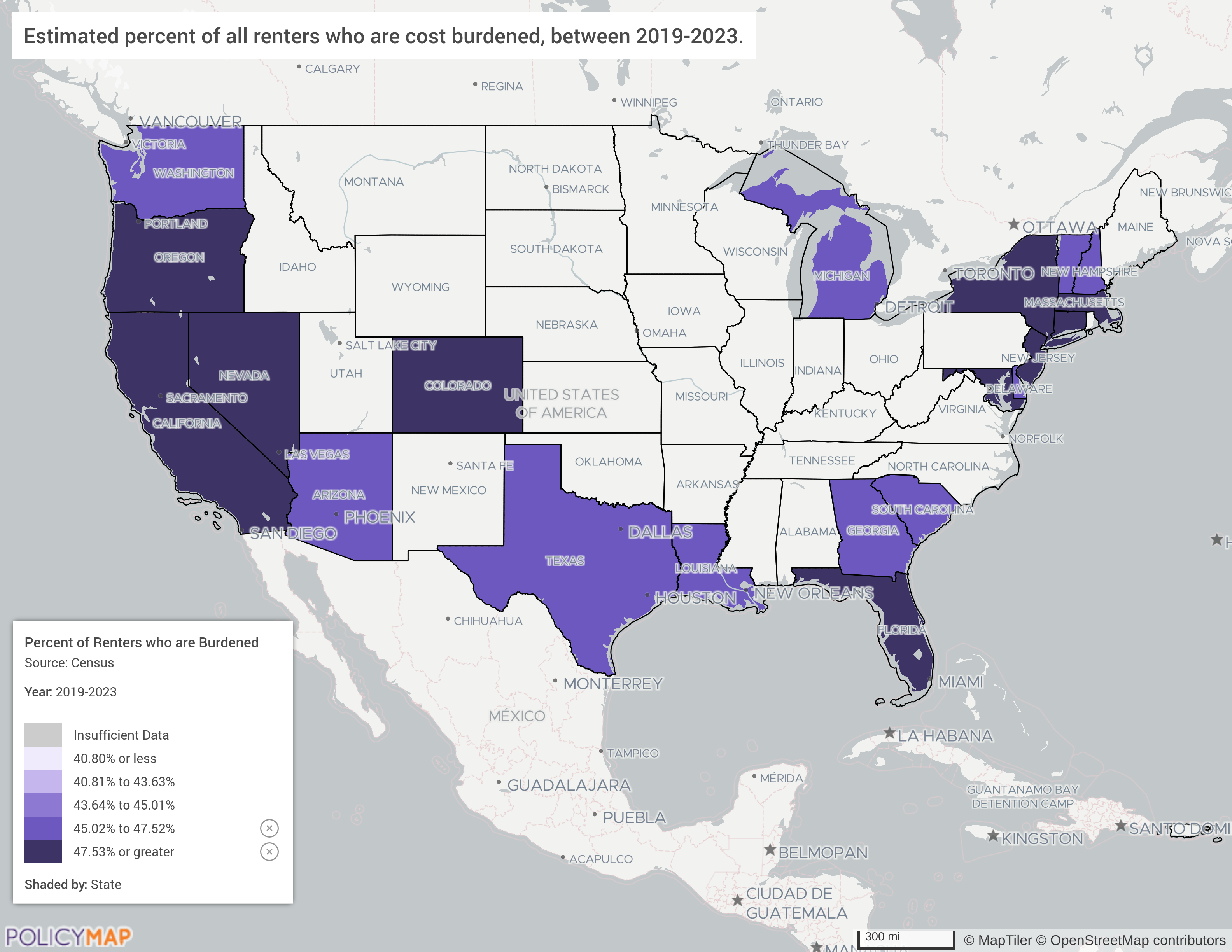

Looking at Census ACS data in PolicyMap for the percentage of renter households who are cost burdened – meaning they spend 30% or more of their household income on rent – Florida and California both make the top 5. In Florida, almost 55% of renter households are considered cost-burdened, and in California this number is roughly 52%. The State of New York is just outside the top 5 while Georgia and Texas rank 12th and 13th, respectively. But overall, comparing the Novogradac map above for states anticipated to finance the most additional affordable homes and the PolicyMap map below for states in the top two quintiles in terms of cost-burdened renters, these LIHTC expansions seem to incentivize affordable housing investment into the states that generally need it the most.

Additional Basis Boost for Rural Areas

One of the BBB provisions that is contributing to this expansion in expected LIHTC financed units is a 30% basis boost for properties located in rural and tribal areas. The basis boost essentially increases the potential amount of equity investment a project can receive through the tax credit. The 30% basis boost currently only applies to properties located in HUD designated Difficult Development Areas (DDAs) and Qualified Census Tracts (QCTs). Extending the basis boost to rural and tribal areas will allow for more properties to be eligible for greater equity investments through the LIHTC program, particularly in states with greater rural and tribal land area.

The Multi-Layer Maps below help to illustrate the impact of this provision. The first map image shows areas currently designated as DDAs and QCTs in Arkansas.

The next map adds rural areas which are defined in the bill as all nonmetropolitan counties and areas meeting the definition of rural under Section 520 of the Housing Act of 1949. The map below uses nonmetropolitan counties according to the USDA.

Opportunity Zones 2.0

The Opportunity Zone proposals included in the BBB include renewal and extension of the program, revised criteria for identifying eligible low-income communities for future designations, bonuses for OZ investments in rural areas and new reporting requirements. Many of these are welcome changes for providing more transparency and data around OZ equity investments, prioritizing investments in areas of deeper distress, and driving more OZ activity into rural communities.

The definition of low-income communities (LICs) has been narrowed to only include census tracts where the median family income is less than 70% of the area median income OR where the poverty rate is 20% or higher. Tracts where the poverty rate criteria is met but where the tract median income exceeds 125% of the area median income are excluded from being LICs. Additionally, the provision from the original OZ legislation which allowed for tracts that were not LICs themselves but were contiguous to an LIC tract to also be designated as an Opportunity Zone has been eliminated. The goal with these modifications is to tighten up OZ designations so that they are reserved for communities that are truly experiencing economic distress.

The Multi-Layer Map below for the Denver area helps to illustrate how OZ designations will change with the revised eligibility criteria. The tracts with black outlines and the dot fill are currently designated OZs. The blue areas are tracts with median family income less than 70% of area median income OR a poverty rate of at least 20% using more current data. Some existing OZs will no longer meet the eligibility criteria so governors will need to designate new OZs from among the pool of eligible LICs.

Other Considerations

These extensions and enhancements to key federal programs like LIHTC and OZs are positive takeaways from the reconciliation bill for housing and community development proponents. However, it’s worth also acknowledging that other proposals have been made by the White House which would significantly reduce public funding through HUD for rental assistance and housing programs for vulnerable populations as well as eliminate grant funding for the Community Development Financial Institutions (CDFI) Fund. These proposals so far have not been taken up by Congress in the reconciliation process but could be incorporated into future legislation or executive actions.

Request More Information

As Congress continues to debate and shape the reconciliation bill, the enhancements to LIHTC and Opportunity Zones represent a critical opportunity to address affordable housing challenges and drive equitable community development. Fill in the form below to schedule a demo, request more information, or get pricing. To stay informed about the latest developments, sign up for our monthly newsletter here.