HMDA: How We Do It

In preparation for our release of the HMDA 2010 data in the next month or so, we wanted to clarify how we process the data, as many of our users have had questions about it.

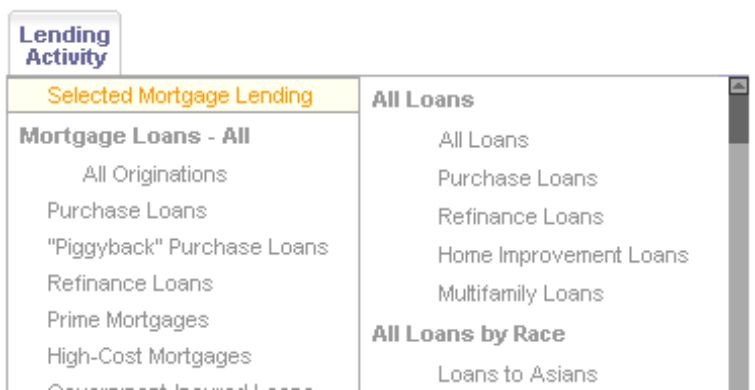

TRF processes the HMDA data in two separate datasets: one is located in the main “Lending Activity” menu and represents our approach to processing the data, while the other is located in the subcategory under “Lending Activity”, called “Selected Mortgage Lending.” The “Selected Mortgage Lending” menu contains data we process for the Federal Reserve Bank of Philadelphia. Their approach to the data differs slightly from TRF’s, and we believe it is important to show both versions.

For all of TRF’s main HMDA data, we first do what we call a “Piggyback” or “80-20” calculation on the records that we receive from the FFIEC. In that calculation, we match up loans that we believe are first- and second-lien loans on the same property by the same borrower. These types of loans are important because they represent cases in which a buyer obtains at least two loans in order to purchase a home. The second loan finances that part of the purchase price not being financed by the first loan. The 80-20 or piggyback loan has been used to avoid underwriting standards held by most lenders that require private mortgage insurance (or PMI) when less than a 20% down payment is made by the buyer. Studies suggest that these transactions have a higher risk of default and foreclosure as the homebuyers have little or no equity at risk. TRF’s piggyback calculation pairs loans that are within the same census tract, from the same lender, and to applicants with the same race, ethnicity, gender, and income. These loans are then combined into one record, the loan amounts summed, thus reflecting the total loan for the property transaction. TRF then counts these combined piggyback loans and the single loans as the universe of all loans from which to filter for the given year.

TRF then processes the data by filtering on values described by the HMDA Loan/Application Register Code Sheet. We count only loans originated from only one-to-four family (other than manufactured housing) properties, only home purchase or refinance loans, and only owner-occupied properties. We then use the HMDA Loan/Application Register Code Sheet to filter by race and ethnicity, prime and high-cost, etc.

For TRF’s “Selected Mortgage Lending” data, we do not run the “Piggyback” or “80-20” calculation on the data, so all loans reported by the FFIEC are counted individually. The only filter that we use from the HMDA Loan/Application Register Code Sheet is counting only loans originated. So, where TRF’s main calculations are only one-to-four family (other than manufactured housing) properties, the “Selected Mortgage Lending” data also contains manufactured housing and multifamily housing. Additionally, the “Selected Mortgage Lending” data contains not only home purchase or refinance loans, but also home improvement loans. It also contains not only owner-occupied properties but also non-owner-occupied properties and those marked “Not Applicable.” For more information about these filtering categories, please see the HMDA Loan/Application Register Code Sheet here: http://www.ffiec.gov/hmdarawdata/FORMATS/2010HMDACodeSheet.pdf