Understand How Home Sale Trends Can Signal Adversity for Prospective Home Buyers

Housing market trends are top of mind for current and prospective homeowners as the past two years of the pandemic have ushered in skyrocketing home sale prices and record-low home purchase inventory. Although seismic shifts in home sale trends such as these could boost wealth accumulation for existing homeowners, they also harm affordability for prospective home buyers and renters.

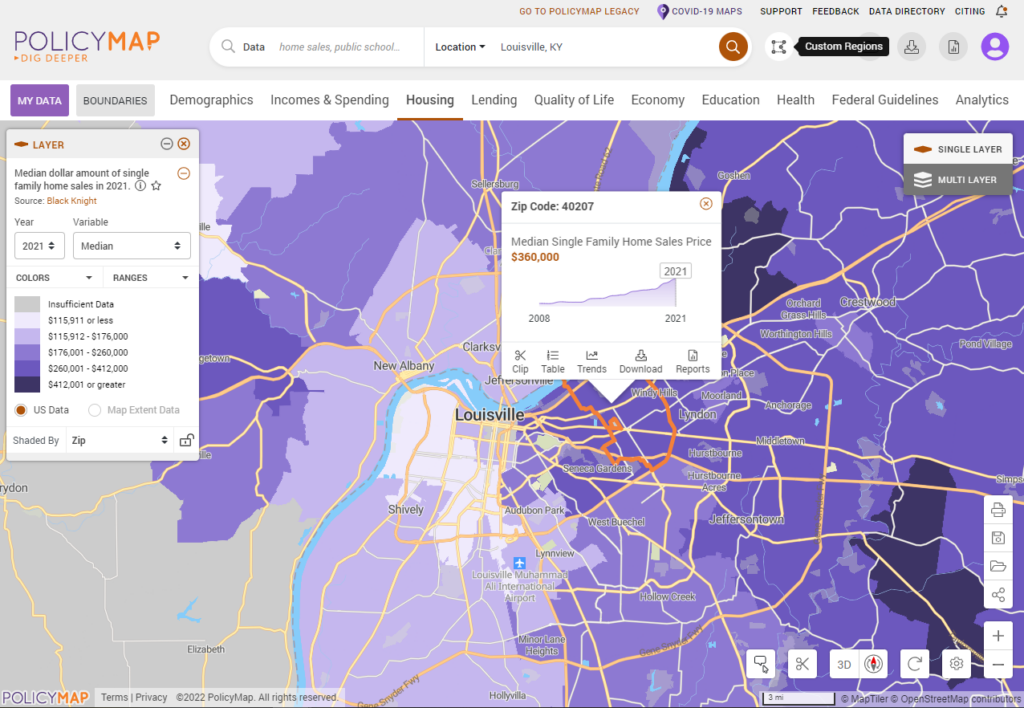

PolicyMap now provides Premium Subscribers with data from a best-in-class home sale vendor at the zipcode level to reveal challenges and opportunities presented by home sale price fluctuations. With this new data, which is available annually and quarterly and is current through 2021Q4 at the writing of this blog post, users can dig deeper into single-family home sales, condominium sales, and mobile home sales volume and prices to understand trends in neighborhoods across the U.S.

Users can see current home sale information their neighborhood, as well as evidence of the escalating prices:

Impact of Home Sale Trends on Homeownership Attainability

A rise in home prices of nearly 30% and a record-low housing inventory over the past two years are just two of numerous barriers to homeownership for potential buyers, particularly for those who wish to transition from renting to owning. However, until recently, lower interest rates have allowed those with down payments in the bank and existing homeowners who wish to save money by refinancing, to benefit financially from home sale transactions. In other words, the hot housing market has primarily only helped those who were already well-positioned financially.

For those with limited down payment options, however, homeownership has become a much further reach than it was before the pandemic, particularly for renters. During the past two years, renters experienced some of the greatest financial stress, reducing their ability to save for a down payment or plan for a home purchase. With 17% of renters across the US behind in rent payments in early 2021, renters experienced setbacks during the pandemic that expanded the gap between owning and buying. And in neighborhoods with heavily cost-burdened households, housing instability may have eliminated the option to join the ranks of homeowners in the near term.

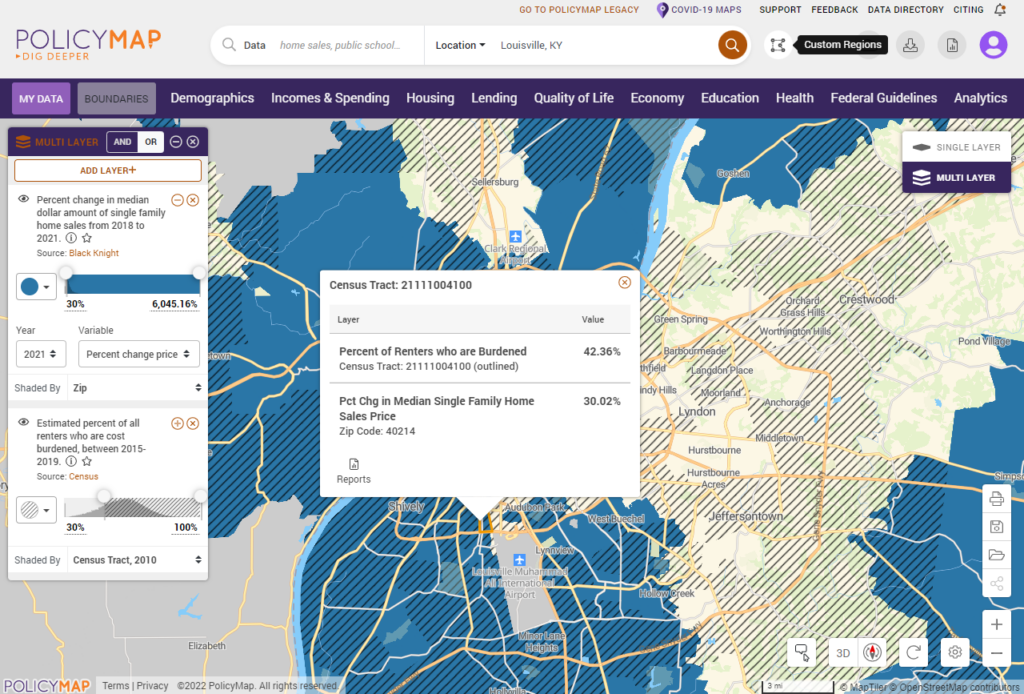

Layering rising home sale prices with cost-burdened renters, we can see where homeownership attainability has likely declined during the pandemic in areas with both blue shading and diagonal hatch marks such as this neighborhood in Louisville, KY:

Looking forward

Despite the significant challenges posed by extreme home sale trend fluctuations over the past two years, the home sale market may be showing signs of rebalancing due in part to increases in mortgage rates. For-sale listings have been falling consistently since August 2021 and are just now starting to rebound. This rebound will likely be reflected in the new home sale data on PolicyMap in the next few months, as the data is updated quarterly and represents the most current summary of home sale data available. The potential cooling of the market does not necessarily mean homeownership will be any more attainable for prospective buyers, given the sizable investment required to purchase a home. To provide opportunities to prospective home buyers, particularly renters, and to avoid a decline in homeownership, additional regulatory interventions will likely be required.