How Opportunity Zones Can Expand Access to Fresh Food in America’s Food Deserts

The Limited Supermarket Access areas data developed by Reinvestment Fund‘s Policy Solutions team was recently updated to show how grocery retail access has changed from 2010 to 2016. This post is by two of our friends from Reinvestment Fund, President and CEO Don Hinkle-Brown and Policy Solutions President, Ira Goldstein. A version of this article previously ran in Impact Alpha.

A critical set of business establishments is often missing from lower-income areas: supermarkets, grocery stores, and other outlets that provide access to a wide variety of fresh and healthy food.

Notable progress has been made in many communities across the US. But food access remains a problem for some 17.6 million residents (down from 20.7 million in 2010). These Americans represent an underserved population larger than the populations in 45 of the 50 states. Those affected are disproportionately lower-income and minority-area residents.

Lack of access to fresh food access is therefore a large problem. But it is well-identified geographically. Through our work, and the work of many other social enterprise lenders, the problem has been shown to be a correctable market failure and not an insurmountable or unsolvable problem.

Written into the 2017 Tax Cuts and Jobs Act was a provision that the Senate architects (Senators Booker [D, NJ] and Scott [R, SC]) hoped would help bring private capital to lower income areas without creating a new government program—the Investing in Opportunity Act. In essence, the provision allowed taxes on capital gains to be deferred if those gains are reinvested in approved census tracts which have characteristics like high poverty and/or low incomes. In each state, governors designated tracts, so there is variation in the place-based strategy and focus across the nation. You can find the national map of Opportunity Zones at PolicyMap.

Capital gains can be reduced significantly if those gains remain in an opportunity fund for more than seven years. And the subsequent capital gains created in those funds can be permanently excluded from tax if the funds remain in the opportunity fund for at least 10 years.

While these can be a straightforward way to postpone or reduce a tax obligation, more importantly, the public quid pro quo for not receiving the taxes on capital gains is that investments meet the intended—purposes of the bill’s authors: “…to support investments in and for economically distressed communities —as opposed to communities already thriving…”; and not to “distort” the program so as to displace residents of distressed communities as Sen. Booker wrote to Treasury Secretary Steven Mnuchin in June. To that end, unless investors are purposeful about meeting the mission-related purposes of the tax benefit, it could easily flow to the most financially advantageous deals that happened to be in (or cynically, relocate to) designated low-income / high-poverty census tracts.

Equity from Opportunity Zone investments could be a significant boost to sparking new grocery locations in similar underserved communities. While New Markets Tax Credits are a highly competitive and scarce resource, there is no practical limit to Opportunity Zone financing given the scale of unrealized capital gains subject to taxation.

By targeting this place-based tax incentive to social problems or barriers that are well-documented spatially (i.e. inequitable food access), such investments can seed under-invested communities with resources and assets. This community infrastructure can underpin new opportunity for a population broader than a business’s specific investors, entrepreneurs or employees.

One way to assure that investors are diligent about meeting the mission-related purposes of the tax benefit versus less impactful investments such as relocated enterprises, would be to marry an investment strategy to a known social indicator.

Reinvestment Fund pioneered an approach to measuring the equity and access to full-service food retail with its LSA analysis. The analysis is spatially sophisticated and includes data and analytic strategies that go well beyond the more usual “food desert” analyses. LSAs are areas defined as having an inequitable and inadequate access to full service food retail for the residents.

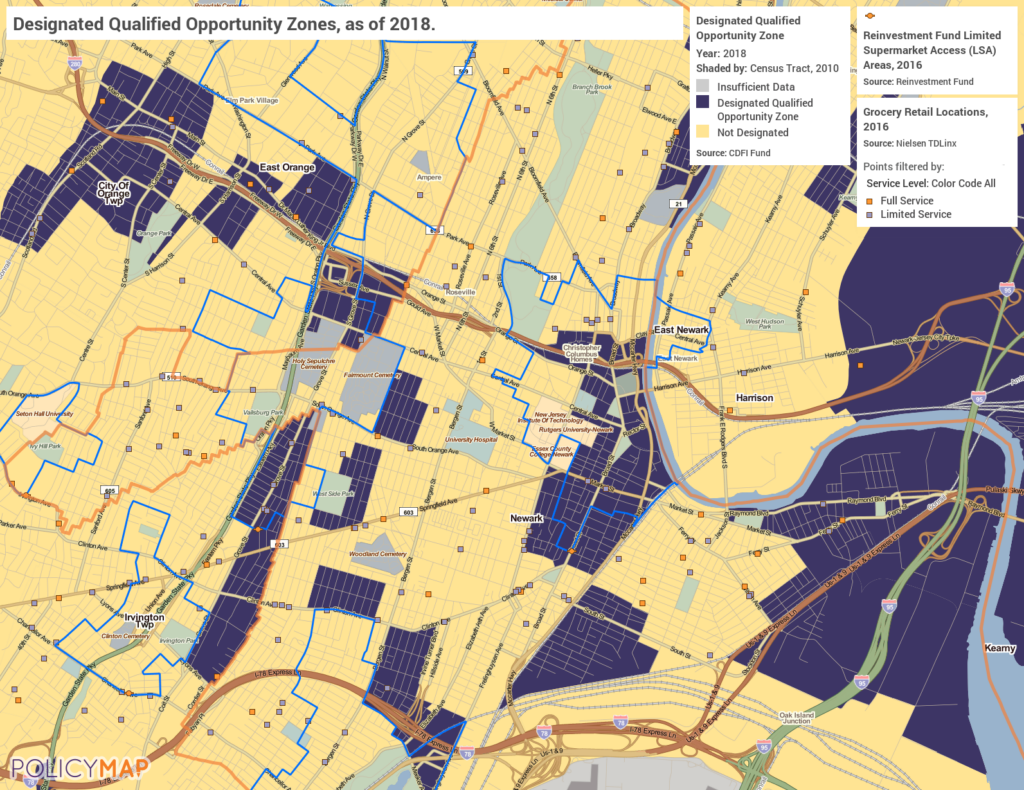

In Newark and elsewhere, there are Opportunity Zones that are not LSAs and LSAs that are not Opportunity Zones – they are not exactly the same places.

Figure 1, a map of the city of Newark, N.J., shows how the Opportunity Zone tax benefit could help address such a critical, spatially defined community issue. By using a base map showing census tracts that are approved Opportunity Zones and overlaying another map representing Limited Supermarket Access (LSA) areas as designated by Reinvestment Fund, an objective, data-based understanding of an area might be used to attract investments subsidized by the Opportunity Zone tax break.

The overlapping area in Newark (which includes a small area outside of the city of Newark) includes 6,587 households that are home to 19,080 people. In that area, people are traveling more than double the distance to access full service food retail as similarly situated but fully middle-income area residents travel. Households in this area of Newark have an estimated aggregate food retail demand of $24 million and a supply of $6.3 million. That means that $17.8 million (nearly three-quarters of total demand) is leaking to other areas in Newark and beyond.

A high-quality, full service proprietor who is willing to open up or expand offerings in this community could reasonably expect revenues of upwards of $17 million per year just from the residents of that area. Supermarkets are generally regarded as low-margin businesses (and therefore higher risk). But within that area there are potential patrons already spending money on food who could be captured by a new or expanded high-quality retail establishment.

Figures 2 through 4, illustrate the overlap between Opportunity Zones and LSA areas in St. Louis, MO, Detroit, MI, and Louisville, KY. Each presents ample opportunities to explore in an effort to address an important problem with this new incentive.

Several local, state, and federal programs along with private investors and not-for-profit investors (like community development financial institutions) have contributed to some real progress in increasing food access in cities and towns across the US.

States and locales have established programs to meet the food access needs of underserved communities. Those programs make available programmatic resources tied to their specific initiative, land, technical assistance and/or coordinated philanthropic resources.

Reinvestment Fund is an active lender and managed the Pennsylvania Fresh Food Financing Initiative. Between 2004 and 2010, $73.2 million in loans and $12.1 in grants were made to 30 projects across the Commonwealth. Overall, Reinvestment Fund invested $300 million in 180 healthy food access projects across the country.

In the last decade-plus, Reinvestment Fund and other CDFIs across the US have financed supermarkets have used a combination of funds from the borrower in the form of equity, debt from lenders like us, and occasionally debt and equity combinations from New Markets Tax Credits (NMTC).

For example, Reinvestment Fund partnered with peer CDFIs to finance a full-service supermarket in a large LSA area in Philadelphia. The ShopRite in Wissinoming has a primary trade area with a total population of 70,489 and a 23% poverty rate. The store was financed through the NMTC program and serves a community with a $79 million demand in food retail according to the LSA analysis. Prior to our store’s opening, 96% of that demand had to be met outside the community.

Yes, supermarket investments are difficult and potentially more risky in lower income areas than the tony areas of many cities or suburban communities. Perhaps the Opportunity Zone tax advantage could both mitigate that risk and meet the objectives of the act’s framers.