Identify Incentivized Locations for Solar, Wind, and EV Charging Facilities Using PolicyMap

Which Communities Will Benefit From The Inflation Reduction Act?

When it comes to energy and climate change, the new Inflation Reduction Act (IRA) sets forth a series of incentives and direct investments for projects designed to reduce carbon emissions, increase energy innovation, and support underserved communities. As a result, a number of these incentives are designed to support clean energy investments in very specific low-income communities around the country. PolicyMap can help make the identification of these places simpler.

Tax Credit Requirements for Solar and Wind Facilities

According to the Act, solar and wind facilities can receive tax credit bonus points for projects that meet the designation of “low-income.”

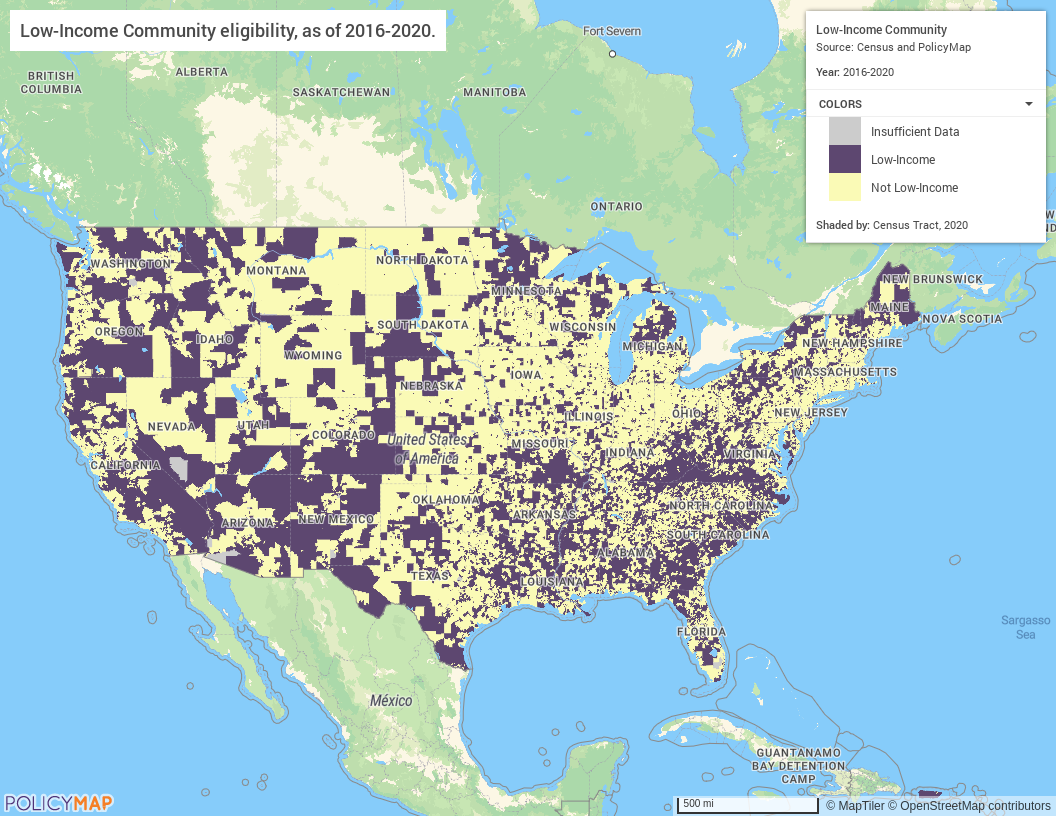

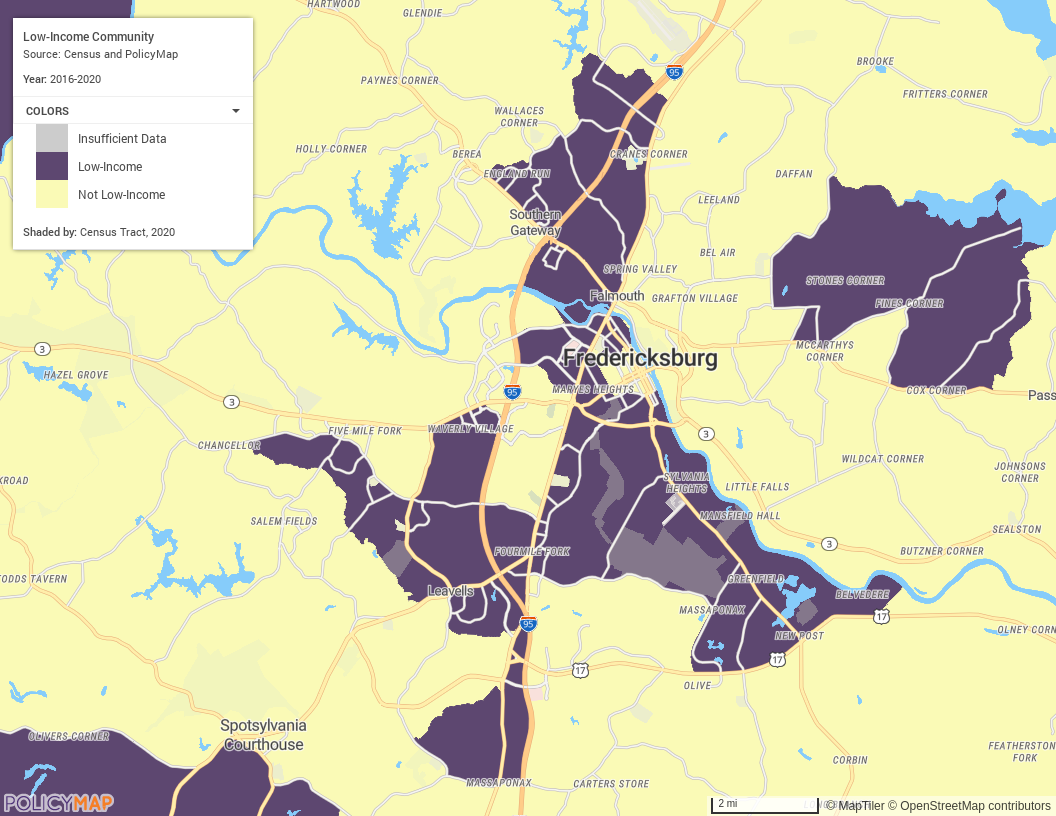

Low-income communities are Census Tracts that have a poverty rate equal to or greater than 20%; or the tract’s median family income in non-metropolitan tracts is equal to or less than 80% of the statewide median family income; or the tract’s median family income in metropolitan tracts is equal to or less than 80% of either the statewide median family income or metro area median family income, whichever is greater. PolicyMap uses data from the 2016-2020 Census ACS, shown at 2020 Census Tract boundaries below:

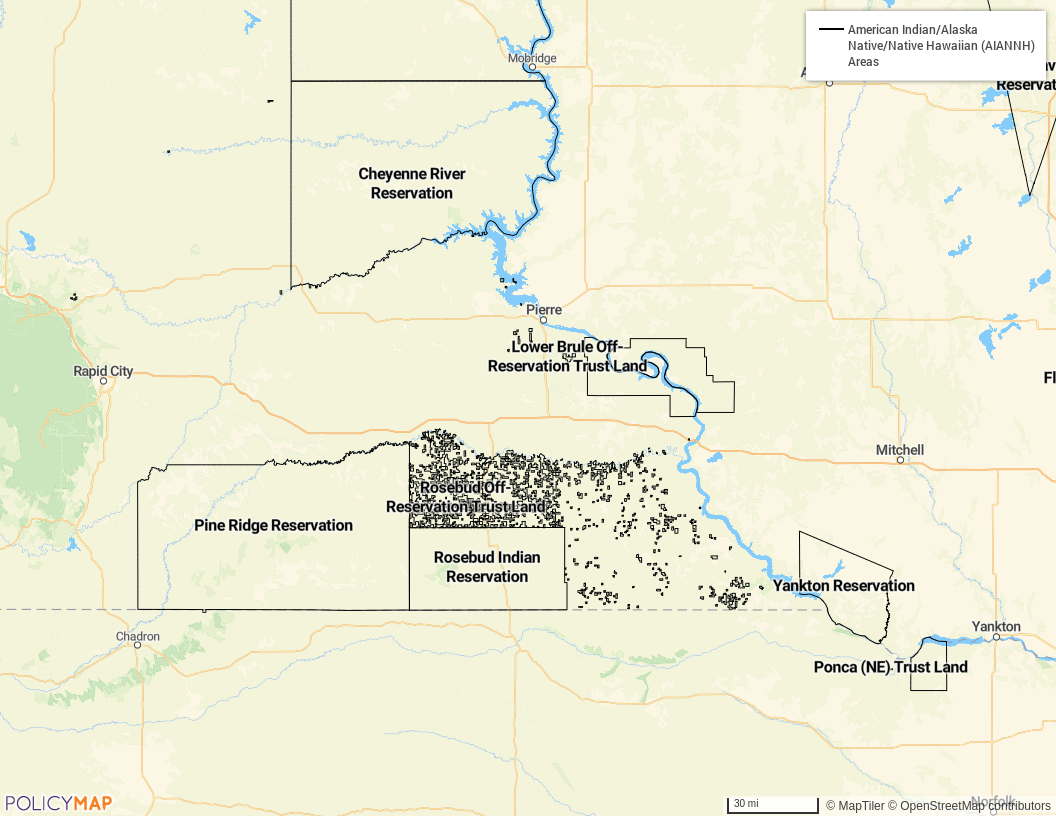

PolicyMap also contains Indian areas where investment would be incentivized as shown as boundaries on the map below.

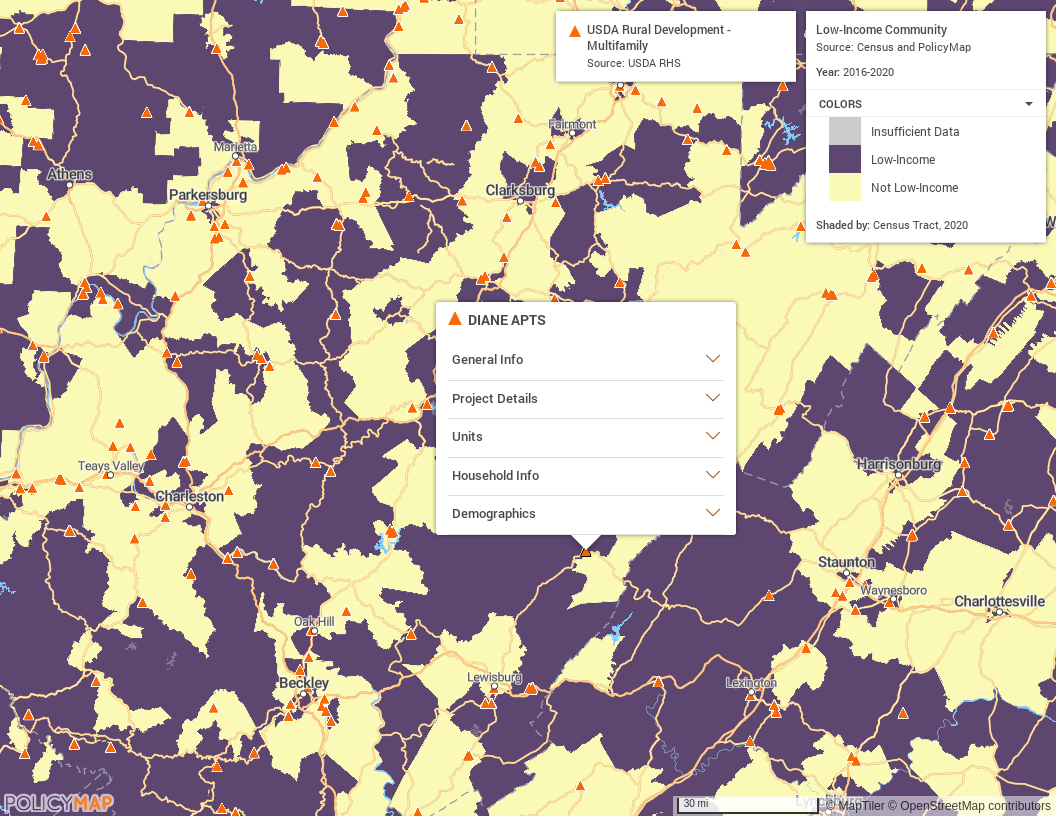

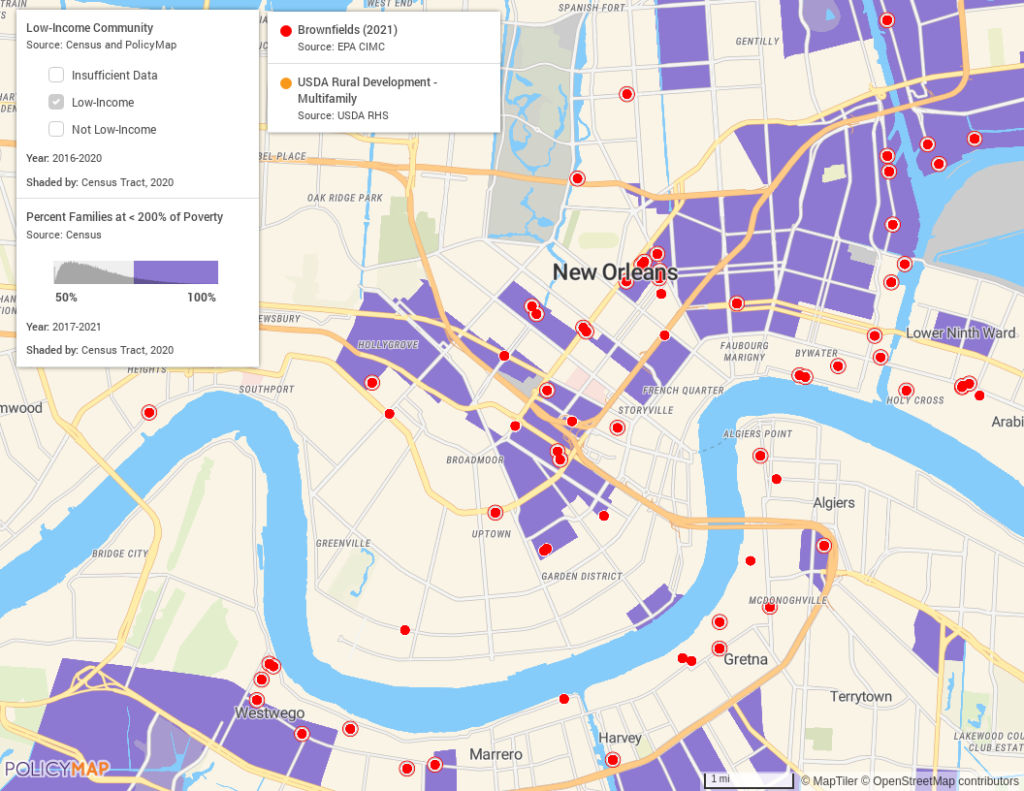

Address a low-income residential building project participating in certain federal housing assistance programs. While the Act does not specify all of the federal housing assistance programs that are eligible for the incentive, it does note that housing assistance programs under the Department of Agriculture qualify. These buildings are available in PolicyMap and, in the map below, for example, are shown as orange triangles. Some of these also sit in within low income areas.

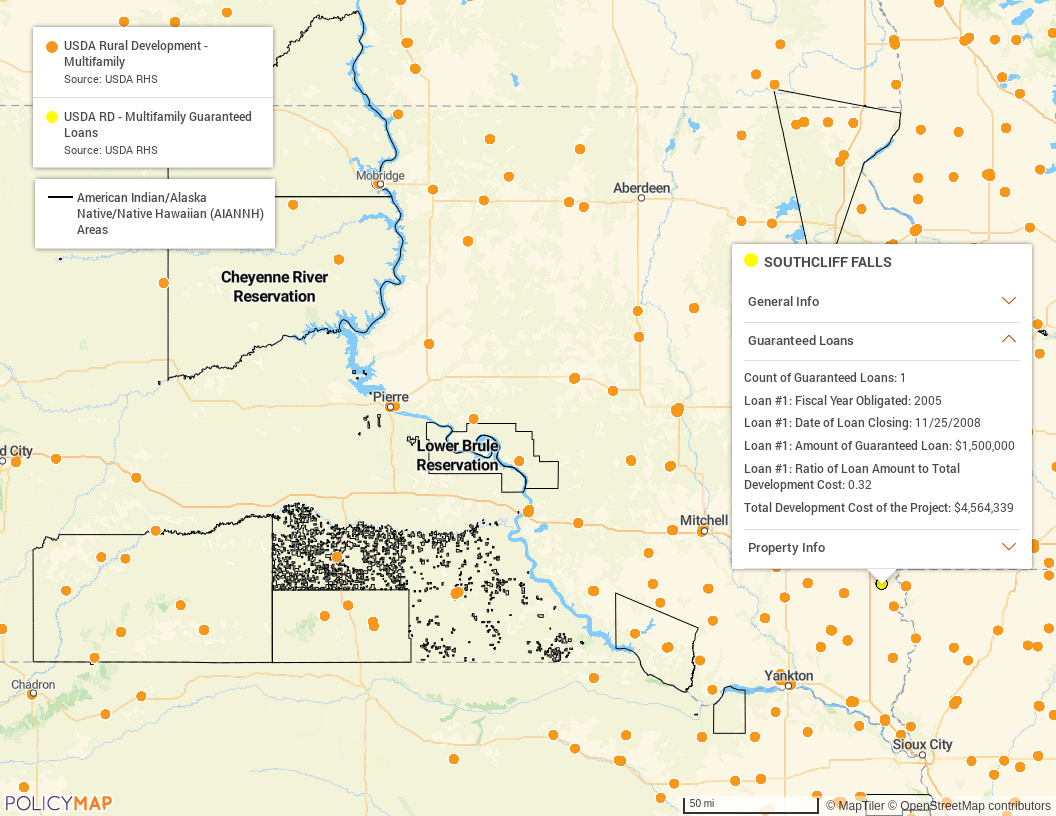

Similarly, some of these buildings sit within tribal areas as noted below.

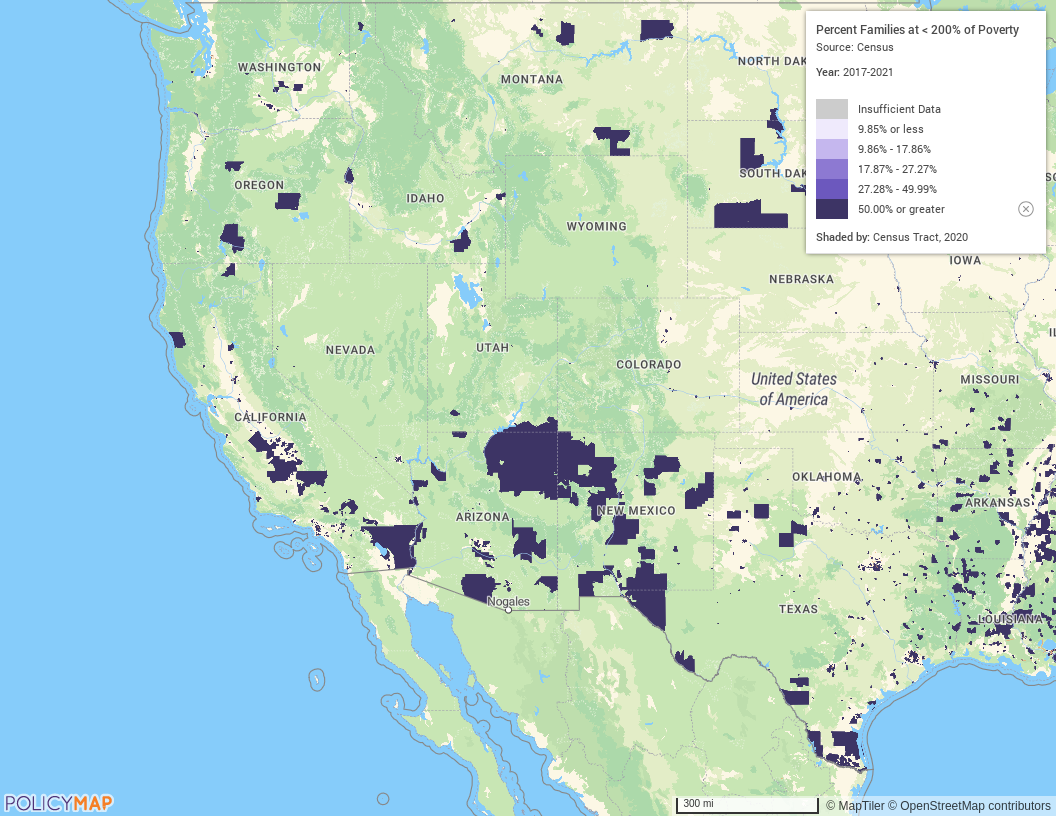

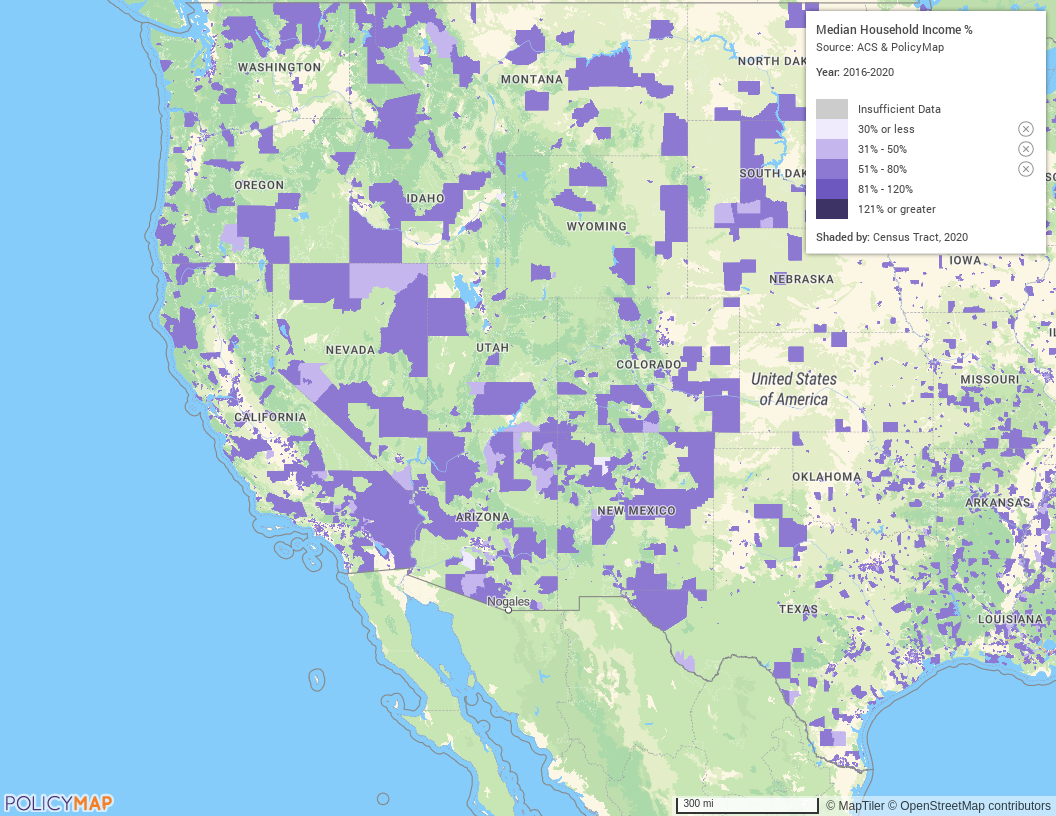

Provide low-income economic benefits where at least 50% of the financial benefits of the electricity produced by the facility must be provided to certain types of households. These households include those with incomes either a) less than 200 percent of the poverty line or b) less than 80% of the area median gross income. Again, PolicyMap has census tract level information for both the percentage of families living below the 200% poverty threshold and where incomes fall below 80% of the area median gross income.

In this first map, just those census tracts where more than 50% of families live at less than 200% of the poverty lines are shaded in purple. In the second map, census tracts where incomes fall below 80% of the area median income are shown. The Act reads that projects in either of these types of locations would be considered eligible for the incentive.

Tax Credit Requirements for EV Charging Stations

EV charging stations are also eligible for tax credits when located in a “low-income community” or within a non-urban area census tract. In the map below, a company contemplating an EV charging station along I-95 in MD, for example, could see the exact locations where the installation of a station could be eligible for incentive.

Tax Credit Requirements for Energy Communities

These facilities, as well as other renewable energy projects such as geo-thermal, biomass and hydropower (among others), can additionally receive tax credit bonus points for projects located in what the Act calls an “energy community”. The Act defines these as follows:

- Brownfield sites

- A metro or non-metro area that a) has had direct employment of .17 or greater or local tax revenues over 25% related to the extraction, processing, transport or storage of coal, oil or natural gas b) has an unemployment rate at or above the national average or c) a census tract or an adjoining tract in which a coal mine closed after December 31, 1999, or a coal-fired electric power plant was retired after December 31, 2009.

PolicyMap contains the location of Brownfields sites across the country and follows how the administration will make information related to tax revenues and coal mines available so that we can have it ready for your important work.

The real value of having all of this data in a single location like PolicyMap is the ability to layer these various criteria and potentially identify where the greatest tax benefit could be achieved or perhaps where clustered investments could yield the greatest impact for communities. If incentives are greater, hypothetically, for investments in Brownfield sites that also qualify as low-income according to the varying definitions, users can quickly filter for these factors and identify the exact buildings where investment makes greatest sense.

We are very much learning about all that is included in the Act as you are and we are making every effort to ensure we have the data you need to make strategic decisions. We are not financial or tax advisors. Our goal is simply to ensure you have accurate, easy-to-access geographic data with which to work. As you learn more, please share with us, and we will continue to do the same.

Are you hoping to take advantage of the incentives? Get answers to your unique questions about our mapping platform and data during a personalized demo. Contact us to schedule yours.