Lobbying Congress on the Historic Tax Credit

By John Leith-Tetrault, National Trust Community Investment Corporation

Historic tax credit (HTC) advocates now have a powerful new tool to use in their lobbying efforts on behalf of the federal HTC. Over the past few months, the Historic Tax Credit Coalition (HTCC) has been working with PolicyMap to geocode the addresses of certified (Part 3 approved) HTC projects from fiscal year (FY) 2002 through FY 2011 so that they can be displayed by state and congressional district. PolicyMap is a program of The Reinvestment Fund, a well-regarded community development entity (CDE) and community development financial institution (CDFI) founded 20 years ago and based in Philadelphia.

Background

PolicyMap (www.policymap.com) is a data warehouse, analysis, and mapping tool that provides users access to social and economic data that can be displayed in tables, charts, reports, and maps that can be viewed online and downloaded. Most importantly, subscribers can upload their own data, layer it with data sets that PolicyMap provides, and share it with others. Launched in 2008, PolicyMap is the largest online geodatabase and has 30,000 registered users. Subscribers include federal, state, and municipal agencies, private corporations, and community development organizations that need to set policy and make investments that have neighborhood-level impacts. The site’s extensive information categories include hundreds of data points related to income, education, unemployment, real estate, crime, vacancy, income, health, and public investments. “PolicyMap is committed to providing access to frequently updated neighborhood-level information that can help both public and private organizations make smart decisions about where they target their resources,” said Phil Vu, technical support manager at PolicyMap.

What the PolicyMap Provides for HTC Advocates

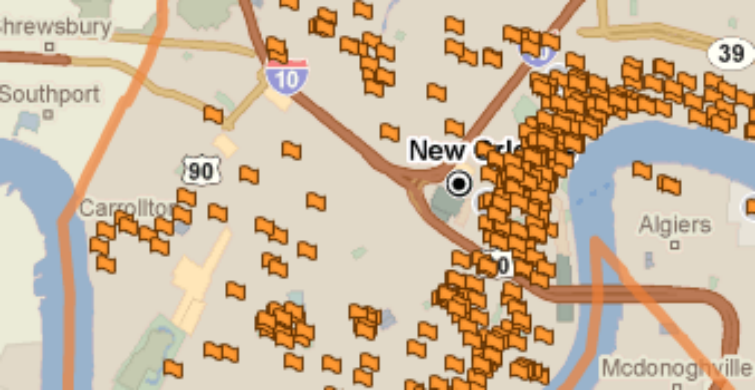

Using transaction-level data provided by the National Park Service, the Historic Tax Credit Coalition has uploaded information on approximately 8,500 HTC projects completed between October 2001 and September 2011. This data will be updated annually. Data points include the address, property use, qualified rehabilitation expenditures, and year placed in service. The site allows HTC advocates to view the location of historic transactions choosing among a variety of boundaries including cities, states, congressional districts, and census tracts. A screenshot of Louisiana’s 2nd Congressional District, represented by Democrat Rep. Cedric Richmond, is shown on page 58 with a dot for each of the HTC projects completed in the district during this 10-year period. PolicyMap also allows the user to view online and download the data points for each transaction in table form. A sample of the printable information on four transactions out of the 2nd District’s 283 projects is also shown on page 58. Qualified rehabilitation expenditures for these transactions were more than $964 million.

Read the entire article by John Leith-Tetrault published in May 2012 on Novogradac’s website.

John Leith-Tetrault has 32 years of experience in community development financing, banking, community organizing, historic preservation, training, and organizational development. He has held senior management positions with Neighborworks, Enterprise Community Partners, Bank of America, and the National Trust for Historic Preservation. Mr. Leith-Tetrault is the founding president of the National Trust Community Investment Corporation and serves as the Chairman of the Historic Tax Credit Coalition. He can be reached at (202) 588-6064 or jleith@ntcicfunds.com.