Low Income Housing Tax Credit Data Updated on PolicyMap!

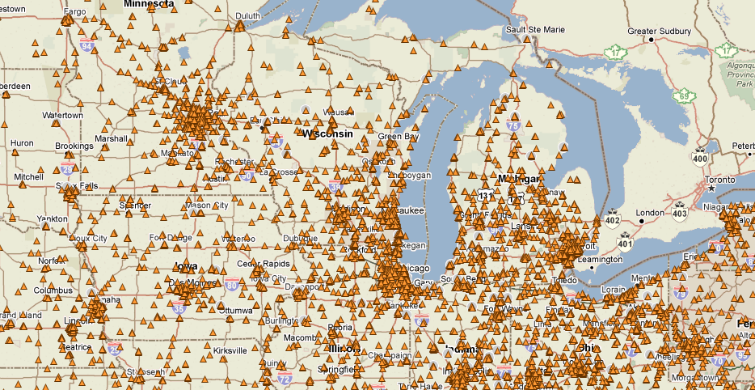

One of our most popular datasets, Low Income Housing Tax Credit (LIHTC) projects, has been updated on PolicyMap! The LIHTC program is an indirect federal subsidy used to finance the development of affordable rental housing for low-income households. It provides tax incentives to encourage individuals, corporate investors, and banks to invest in the development, acquisition, and rehabilitation of affordable rental housing. According to one estimate, the LIHTC program has helped to finance the development of more than 2.4 million affordable rental housing units since its inception in 1986. The data, released annually by the Department of Housing and Urban Development (HUD), now includes all projects that have been placed in service through 2012. Use the map below to explore LIHTC projects in your local area!

With this update, we added a filter option allowing users to view only the properties that are currently active in the LIHTC program. Because HUD does not remove properties from its database, it includes projects not currently being monitored in the LIHTC program. Why might a project cease being active in the LIHTC program? It could be because the project did not meet all compliance rules, or due to foreclosure. Or, more likely, it could be that the owners opted out of the program after the 15 year mark. While LIHTC requires a property remain in compliance for 30 years, the tax credits, which are claimed over a 10-year period, can be recaptured over the first 15 years. At that time, investors often sell their stake in the property. After 15 years, owners can opt-out of the program, but the state has the option of finding a buyer who will maintain the rent and income restriction for the remaining 15 years. Further, some states require even longer affordability periods beyond the federal minimum of 30 years.

You can read more about the LIHTC program on HUD’s website or by visiting Novogradac’s Affordable Housing Resource Center.