Understand the Racial Homeownership Gap Using Ownership Data from PolicyMap

Data

Racial Homeownership Gap

Source

PolicyMap calculation of ACS data

Find on PolicyMap

- Housing

- Homeowners and Renters

- Racial Housing Disparity

- Homeowners and Renters

The racial homeownership gap, or the difference in homeownership rate between non-Hispanic white people and people of other races, remains one of the most critical issues in the United States today. Homeownership is essential for wealth building, and it’s becoming more difficult for people of color to obtain mortgages, specifically, Black and Hispanic/Latino households. Historically, Black neighborhoods were left out of home mortgages due to redlining, and even with the 1968 Fair Housing Act, the homeownership gap has not narrowed.

In addition to building wealth, homeownership can provide a greater sense of overall security, control, and confidence over one’s life. Owning a home allows families to build generational wealth and provide economic security for years with the ability to pull equity out of them for education, home improvements, and unexpected expenses.

PolicyMap created new indicators measuring the racial homeownership gap throughout the United States. These measures make it possible to compare numerous geographies and understand where disparities lie.

Historical and Present State of Homeownership Disparities

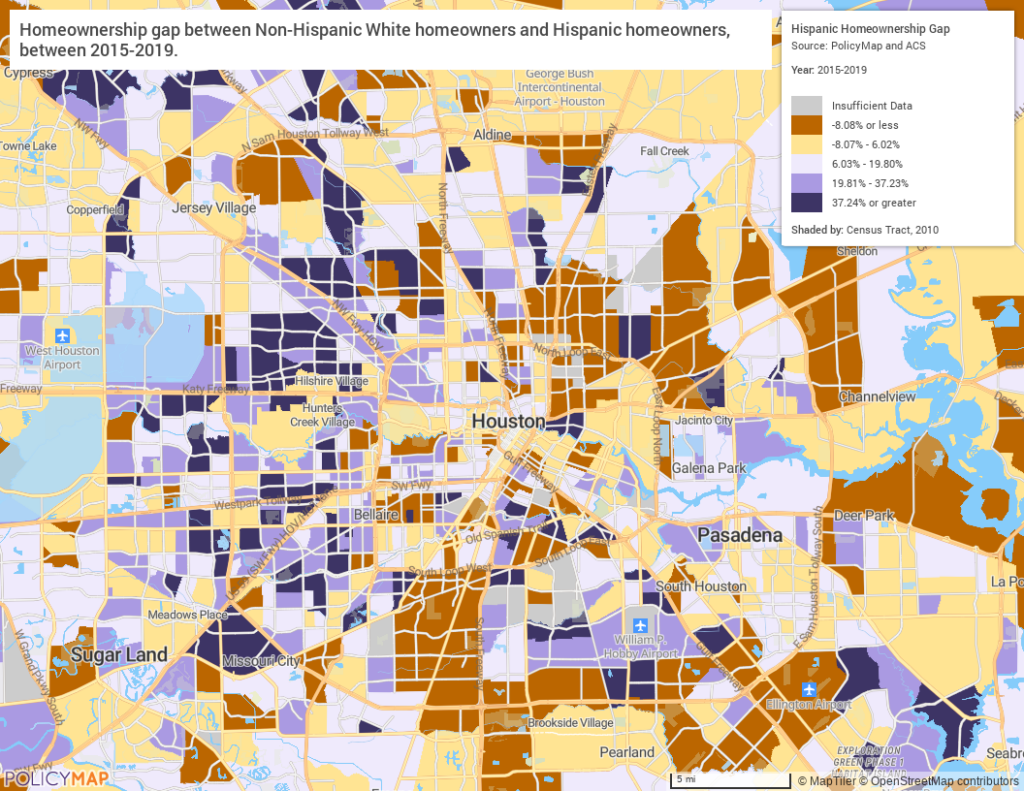

The great recession was a turning point in homeownership. Before the recession, the homeownership gap narrowed. But afterward, the gap widened. The 2005-2009 ACS estimates show that the homeownership gap between non-Hispanic white homeowners and Black homeowners was 27.63 percent. While today the gap is 30.10 between Non-Hispanic White and Black homeowners. Between 2005-2009, the gap is slightly narrower for Non-Hispanic White to Hispanic or Latino households at 24.29; presently, it is 24.67. The cities with the most Black and Hispanic or Latino homeowners are New York, Chicago, and Houston. Additionally, they are some of the most populated cities in the country and can provide insight into areas where homeownership increased or decreased regardless of race.

Narrowing the Homeownership Gap

The map below shows Houston’s neighborhoods with the narrowest percentage gap of homeownership between Non-Hispanic White homeowners and Hispanic/Latino homeowners in yellow and orange. Some census tracts are even in the negatives, indicating that the homeownership rate for Hispanic/Latino households is higher than for white households. Most likely meaning a more segregated area.

Inequitable Lending in Narrowing the Homeownership Gap

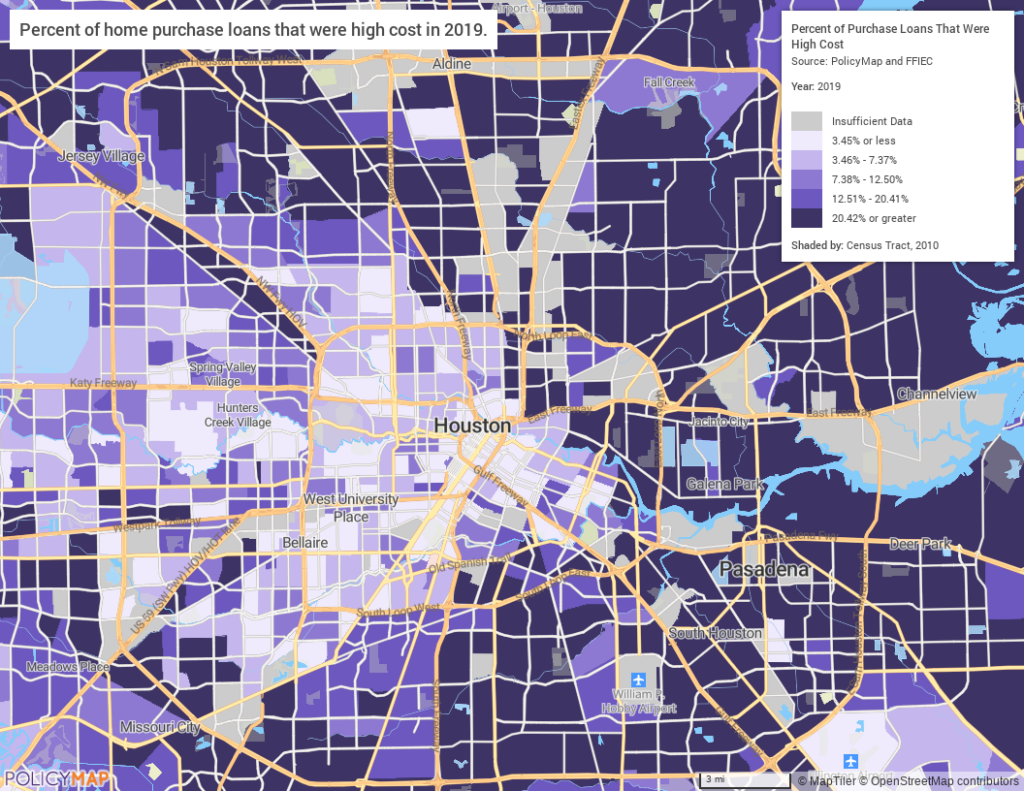

However, not all home loans are equal, especially when it comes to the type of loan. Borrowers deemed riskier may not qualify for a traditional prime loan resulting in the origination of a high-cost loan, also known as a subprime loan. This can make owning a home even more costly due to the additional interest borrowers pay. Research has shown that Black and Hispanic or Latino households are more likely to get a high-priced loan than white borrowers. The map below shows the percent of home loans that were high cost in 2019. We can see some of the areas with the narrowest gaps received the most high-cost loans. This indicates that homeownership in these areas was obtained by expensive lending products making it more challenging to pay off due to the higher interest rates, potentially resulting in foreclosure if a family is in a precarious financial situation.

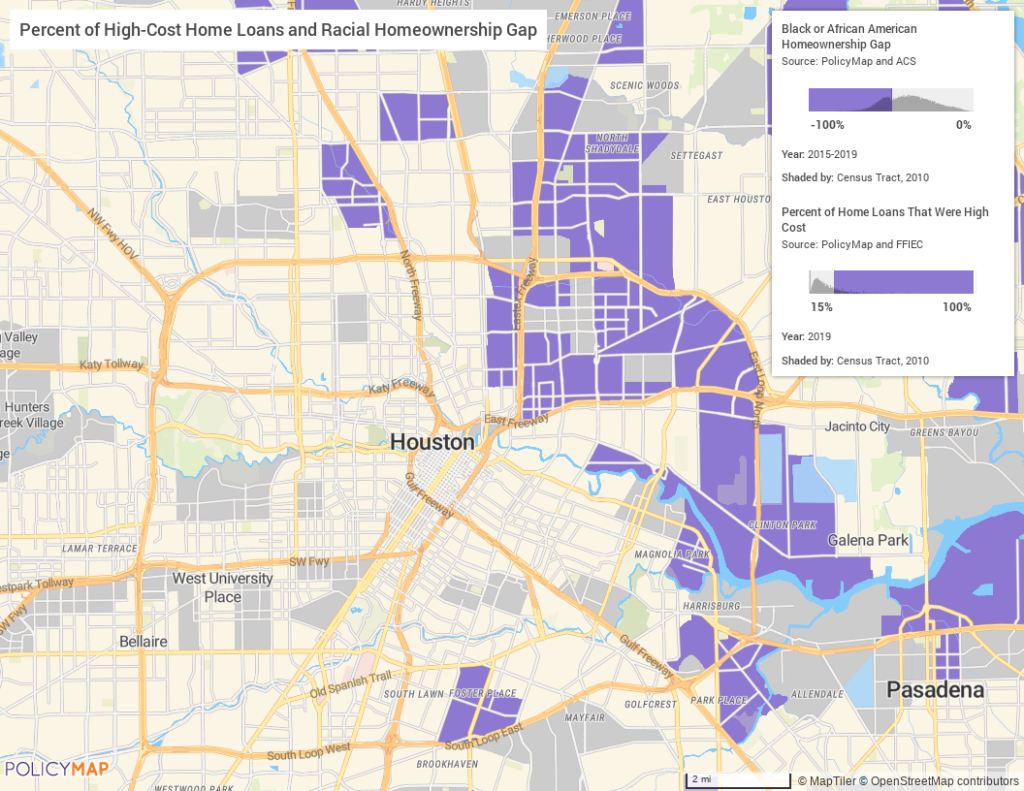

The map below overlays the percent of high-cost loans to Black borrowers and areas with the lowest homeownership gap between 2015-2019. This shows the neighborhoods at the intersection of the two indicators, where 15% or greater of home loans were high-cost and the homeownership gap decreased.

Downstream Effects of Homeownership

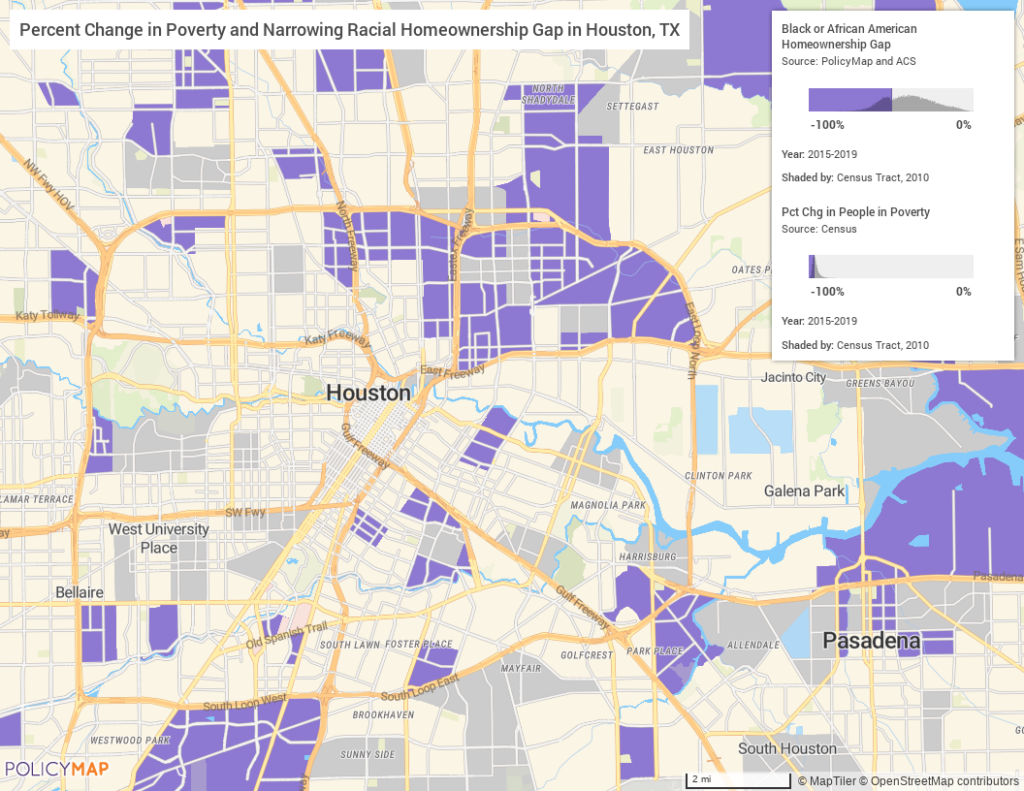

Homeownership can be the gateway to generational wealth and decreases in poverty. Below is a map showing the changes in poverty and areas with lower gaps in homeownership. These are areas where Black homeownership narrowed the gap between Non-Hispanic white and saw a decrease in poverty.

Owning a home is very important, and providing affordable, equitable products to achieve homeownership is a must. Addressing the issues of homeownership and lending requires knowing which areas are the most affected and understanding how policy can change it.

These are just a few ways to explore the new Racial Homeownership Gap data on PolicyMap. With the hundreds of other indicators, users will gain insight into health, quality of life, and education related to homeownership.