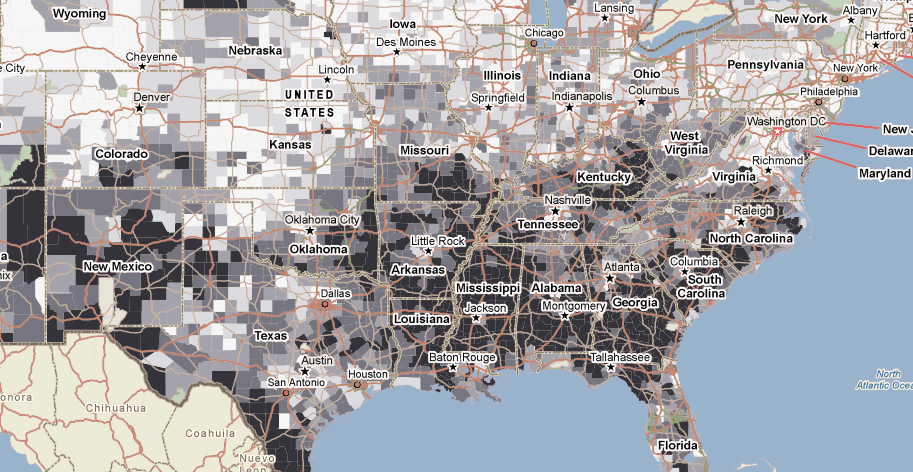

Zip Codes with Highest Earned Income Tax Credit in 2006

The Brookings Institution uses data from the IRS to construct a broad database of tax return data, available by ZIP code, city, county, metropolitan area, state, state legislative district, and congressional district, for every year from 2000 to 2006. The data is available in PolicyMap in the "Money & Income" tab, in the "Federal Tax Returns" section. Due to privacy concerns, some areas with very low counts have suppressed data. Listed here are the top 10 zip codes that do not contain suppressed data.

Average amount of Earned Income Tax Credit (EITC) in 2006

| Zip Code | City, State | Average amount of Earned Income Tax Credit (EITC) in 2006 | |

|---|---|---|---|

| 38731 | Chatham, MS | $3,387.64 | |

| 10950 | Monroe, NY | $3,169.87 | |

| 36722 | Arlington, AL | $3,115.45 | |

| 36104 | Montgomery, AL | $3,093.56 | |

| 10952 | Monsey, NY | $3,073.73 | |

| 70436 | Fluker, LA | $3,070.18 | |

| 36751 | Lower Peach Tree, AL | $3,067.95 | |

| 59064 | Pompeys Pillar, MT | $3,041.36 | |

| 36540 | Gainestown, AL | $3,023.59 | |

| 36786 | Uniontown, AL | $3,013.31 |

Do you want to learn more about this dataset or other features on PolicyMap? Join our free weekly trainings (Click Here) or send your questions to pmap@policymap.com.