Using Tax Incentives to Encourage Low-Income Housing Constructions

Data

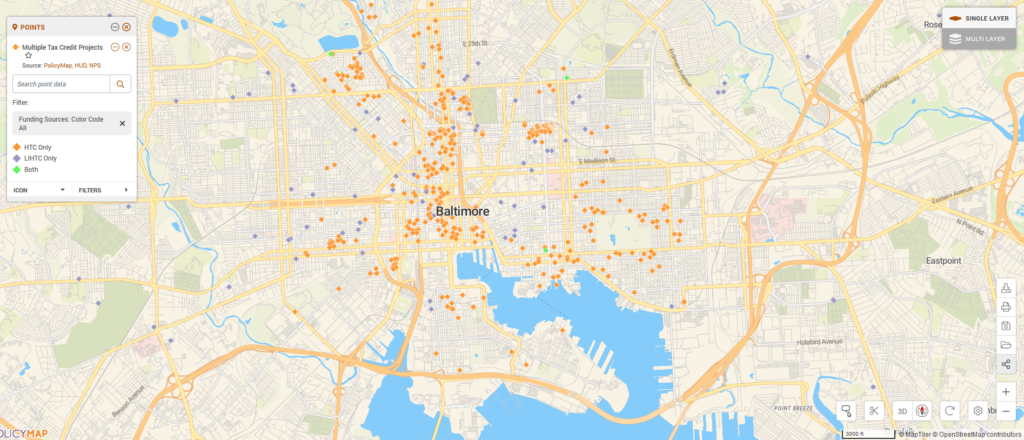

PolicyMap, HUD, and NPS: Multiple Tax Credit Project Locations

Source

Find on PolicyMap

- Federal Guidelines

- Federal Housing and Subsidy Locations

- Multiple Tax Credit Projects

- Federal Housing and Subsidy Locations

One way housing agencies encourage developers to dedicate new apartments or houses to low-income residents is through federal tax credit programs. Tax credit programs work by enabling state housing agencies to award credits to developers, who can then trade these credits to investors in exchange for funding the construction project. Two such tax credit programs—Low Income Housing Tax Credits (LIHTC), and Historic Tax Credits (HTC)—have proven to be a valuable tool for state agencies to encourage low-income housing development. Since the LIHTC program was signed into law in 1986, it has been used to create more than 3 million new housing units, and the HTC program has been used since 1976 in more than 45,000 projects. Although the two programs aim to solve two different objectives (affordable housing and historic preservation, respectively), developers can use both incentives together to achieve a “bottom line” that serves the community and incentivizes the development. PolicyMap has created a new dataset that allows users to see information on both programs together, including projects where developers have used the two types of tax credits together to assemble funding for the project. Additionally, this new data includes a filter for whether or not a given property is proximal to (or also includes) New Markets Tax Credit investments. By considering all three stacked incentives, developers can identify properties that successfully used these tax credits.

When paired with other data on PolicyMap, such as New Markets Tax Credit Eligibility and Opportunity Zone status, low-income housing advocates and developers can easily identify where these tax credit programs could be put to best use, providing social impact and ensuring a return on investment.

For more information about detailed stacked incentives for affordable housing, we recommend consulting the National Housing Preservation Database, a valuable database for low-income housing advocates and nonprofits.

About the data

The LIHTC and HTC project location datasets are maintained by two different federal agencies using different formatting. Neither dataset contains information on whether the other tax credit program was used for a given project. To gauge overlap between the two programs, PolicyMap used three matching criteria—address standardization, fuzzy matching of the project name, and similarity of the project time frame. Feeding the raw non-standard address information from the project location datasets into a geocoder produced clean, standardized versions of those addresses that were suitable for matching. Then, PolicyMap fed the project names through an algorithm that determined whether two names were nearly identical for a second layer of matching. Finally, matches were limited to a three-year window of similarity between the listed project year in each dataset. Manual review of the finalized matches showed a high level of accuracy. Also included in this dataset is how many projects in the census tract took advantage of the New Markets Tax Credit within a three-year window.